Security & Geopolitics: Crypto Risks and Global Power Plays

When navigating Security & Geopolitics, the intersection of political forces, regulatory measures, and digital‑asset safety, you quickly see how it pulls in tools like VPN, virtual private networks that mask IP addresses and encrypt traffic, policies such as OFAC sanctions, U.S. trade restrictions that target specific countries and entities, and threats like cryptocurrency theft, illegal acquisition of digital funds through hacking, mixers, or illicit mining. Together they shape how traders, investors, and governments act in places from Tehran to Pyongyang. Security & Geopolitics isn’t just a buzzword; it’s a live network of actions where a VPN decision can trigger an account freeze, a new sanction can rewrite a country’s compliance checklist, and a state‑run hacking group can turn stolen coins into missile fuel. By unpacking the relationships—VPN usage influences regulatory risk, sanctions drive market migration, and crypto theft fuels geopolitical agendas—you’ll see why every headline about a blocked exchange or a busted mixer matters to anyone holding digital assets. Below you’ll find curated pieces that drill into each of these moving parts.

Why the Mix of Tech, Law, and Power Matters

Take Iran, for example. Crypto traders there rely on VPNs to bypass national firewalls and access global platforms. That reliance creates a cat‑and‑mouse game: authorities develop deep‑packet inspection tools to spot VPN signatures, while users switch to obfuscation protocols that blend with regular traffic. The risk isn’t just a temporary login glitch; a detected VPN can lead to frozen accounts, confiscated funds, or even legal action under local cyber‑crime statutes. Understanding this dance helps you gauge the true cost of “just another privacy tool.” Meanwhile, Syrian users faced a different puzzle in 2025 when the U.S. Treasury issued a General License that relaxed some OFAC restrictions. The change opened doors for licensed exchanges, yet many firms stayed cautious, fearing secondary sanctions or reputational fallout. The lesson here is clear: even a partial sanction relief reshapes compliance workflows, requiring fresh risk assessments, AML upgrades, and constant monitoring of licensing updates. Across the continent, the same pattern repeats—regulatory shifts rewrite the rules of engagement, and anyone in the crypto space must adapt fast to stay compliant and secure.

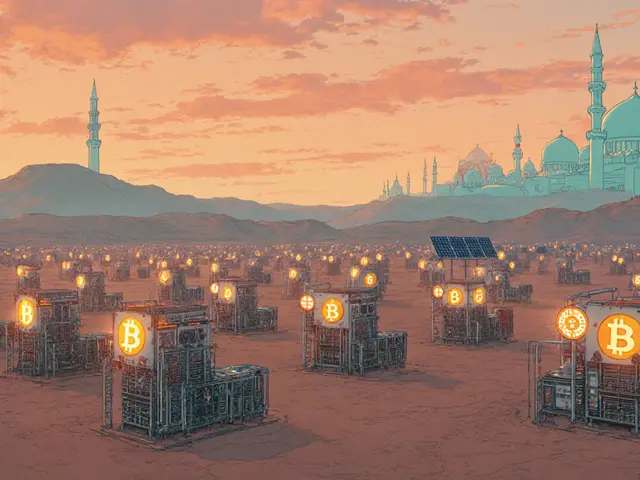

On the other side of the globe, North Korea demonstrates how state actors weaponize crypto theft. The Lazarus Group runs massive cryptojacking campaigns, hijacking unsuspecting computers to mine coins that funnel into mixers—services designed to obscure transaction trails. Those laundered funds then finance missile development and nuclear research, creating a direct feedback loop between digital crime and physical threats. International coalitions are deploying blockchain analytics, sanctions lists, and targeted cyber operations to choke that money flow, but the cat‑and‑mouse dynamic persists. This scenario illustrates a core principle of security & geopolitics: financial networks are not isolated from geopolitical ambitions; they are a conduit for power projection. Recognizing how illegal crypto extraction feeds into broader security concerns equips you to evaluate risk beyond price charts—thinking about supply‑chain integrity, sanction‑evading techniques, and the geopolitical fallout of a single hacked wallet. The articles below dive deeper into each of these case studies, offering practical tips, compliance checklists, and a clearer picture of how global politics shape the crypto landscape.

23

DEX Security: Risks and Protections in Decentralized Trading

DEXs offer freedom from centralized exchanges but come with hidden risks like smart contract bugs, infinite token approvals, and fake websites. Learn how to protect your crypto and avoid losing money on decentralized trading platforms.

4

dApp Security Considerations: Essential Practices for Secure Decentralized Applications

dApp security is critical as decentralized applications face unique threats from smart contract flaws to phishing attacks. Learn key practices like smart contract audits, frontend protections, and privacy mechanisms to safeguard your dApp. Current standards like OWASP SCSVS help developers build secure systems. Real-world examples highlight the cost of neglecting security. Follow these steps to protect users and assets.

19

MarketExchange Crypto Exchange Review: A High-Risk Scam to Avoid in 2025

MarketExchange.io is not a legitimate crypto exchange - it's a scam operation with no regulatory licenses, no security audits, and fake staking returns. Avoid it at all costs.

14

CryptoSX Crypto Exchange Review: Why It Doesn't Exist and What to Watch Out For

CryptoSX is not a real crypto exchange - it's a phishing scam. Learn why it doesn't exist, how to spot fake exchanges, and which legitimate platforms to use instead in 2025.

17

Cost of Sybil Attack vs Network Value: Why Blockchain Security Depends on Economics, Not Just Code

The cost of launching a Sybil attack on major blockchains like Bitcoin and Ethereum far exceeds the potential reward, making such attacks economically irrational. Smaller networks with low market caps remain vulnerable.

7

How VPNs Affect Crypto Trading in Iran: Risks, Detection, and Survival Tips

A detailed look at how Iranian crypto traders rely on VPNs, the growing detection methods, and practical steps to reduce the risk of account freezes and legal trouble.

26

North Korea’s Crypto Theft: Funding WMD Programs Explained

Explore how North Korea uses stolen cryptocurrency-mainly through cryptojacking and mixers-to fund its nuclear and missile programs, the key players involved, and global efforts to stop the money flow.

23

How OFAC Sanctions Shaped Syrian Crypto Users in 2025

Explore how the 2025 OFAC sanctions relief reshaped Syrian crypto users, from new licensing to remaining restrictions, and learn practical compliance steps.

Latest Posts

Popular Posts

Tags

- decentralized exchange

- crypto exchange

- crypto exchange review

- cryptocurrency

- crypto airdrop 2025

- CoinMarketCap airdrop

- blockchain

- meme cryptocurrency

- GENIUS Act

- cryptocurrency compliance

- crypto airdrop

- meme coin

- crypto trading

- fake crypto exchange

- Solana meme coin

- cryptocurrency valuation

- Binance Smart Chain

- underground crypto Nepal

- crypto airdrop guide

- crypto staking