9

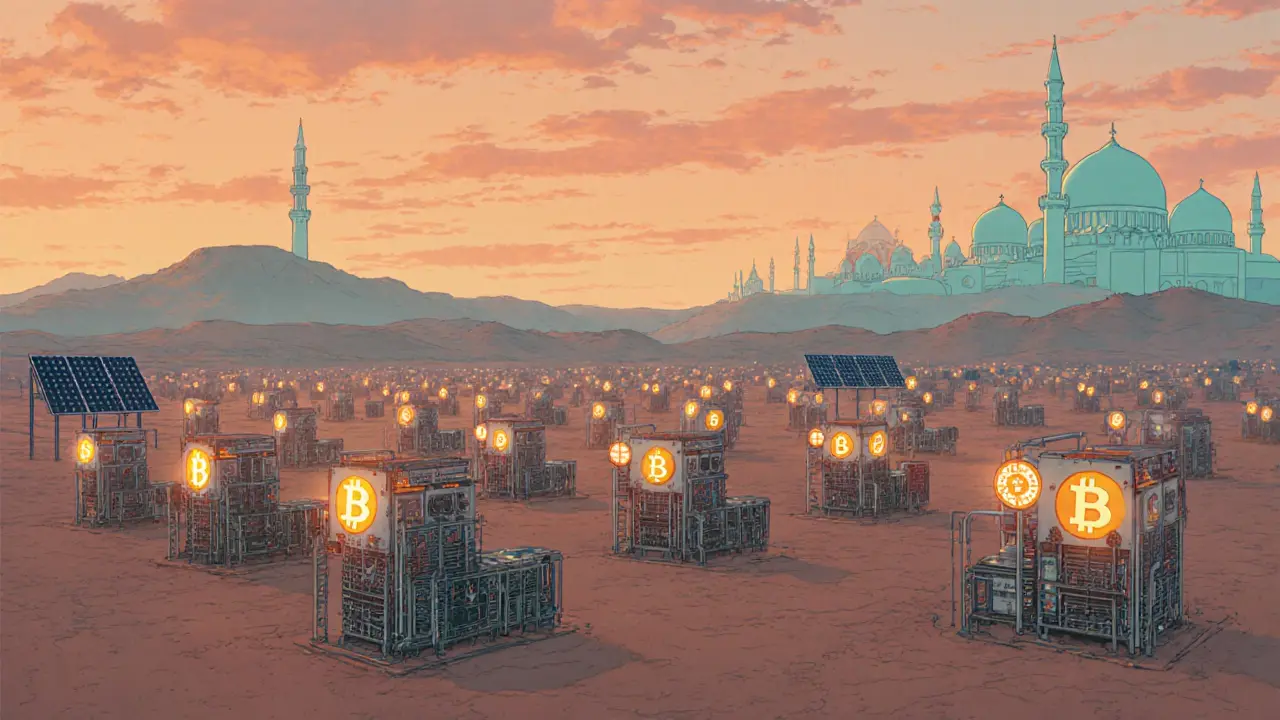

How Iran Uses Bitcoin Mining to Bypass International Sanctions

Iran Bitcoin Mining Revenue Calculator

Mining Input Parameters

Iran's Energy Advantage

Iran's electricity costs: 0.5 cents/kWh (state-linked operations)

US average electricity costs: 13.3 cents/kWh

Global Bitcoin mining energy: 1,500 kWh per Bitcoin

Revenue Analysis

Note: These calculations assume 100% mining efficiency and constant electricity costs. Actual revenue varies based on network difficulty, hardware quality, and market conditions.

Iran isn’t just mining Bitcoin-it’s building a financial lifeline out of it. While most countries see cryptocurrency as a speculative asset or a tech experiment, Iran turned it into a state-backed tool to survive global sanctions. Since the U.S. pulled out of the Iran nuclear deal in 2018, the country has been cut off from the global banking system. SWIFT transactions froze. Dollar accounts vanished. Traditional exports like oil became harder to sell. So Iran did something unexpected: it started mining Bitcoin at an industrial scale, using its cheap energy to generate hard currency on the open market.

Why Bitcoin? Because It Doesn’t Need a Bank

Sanctions work by controlling money flows. Banks refuse to process payments. Payment processors like Visa and Mastercard block transactions. But Bitcoin? It doesn’t care who you are or where you’re from. All you need is an internet connection and a mining rig. Iran realized this early. Instead of fighting the system, it built its own parallel economy inside it.

By 2025, Iran accounted for about 4.5% of the entire world’s Bitcoin mining power. That’s more than Russia, and nearly as much as Canada. The numbers don’t lie: over $4 billion in cryptocurrency flowed out of Iran in 2024 alone-a 70% jump from the year before. These aren’t small-time hobbyists. These are massive, state-backed operations running 24/7, using electricity that costs almost nothing.

The Energy Advantage: Mining on the Cheap

Bitcoin mining eats electricity. A lot of it. To mine one Bitcoin, you need roughly 1,500 kWh. Iran doesn’t just have power-it has surplus power. The country sits on the world’s second-largest natural gas reserves. It also has massive power plants built during the oil boom years that now run at half capacity because exports are blocked.

Iran’s mining farms don’t pay market rates. They pay next to nothing. In Rafsanjan, a 175-megawatt mining facility sits on land controlled by the Islamic Revolutionary Guard Corps (IRGC). It’s powered by gas turbines that would otherwise idle. The electricity? Effectively free. That gives Iranian miners a massive edge. In the U.S., electricity costs between 3 and 8 cents per kWh. In Iran, it’s closer to 0.5 cents-or even zero for state-linked operations.

This isn’t just about profit. It’s about survival. The electricity used by Iranian miners is equivalent to burning 10 million barrels of oil per year. That’s 4% of Iran’s total oil exports. But instead of selling oil for dollars that get frozen, Iran sells Bitcoin-and converts it into euros, yuan, or stablecoins that can actually be spent.

How It Works: From Mining to Money

It’s not as simple as turning on a machine and getting rich. Iran’s system is layered:

- Miners run ASIC rigs-mostly Chinese-made hardware smuggled in through third countries.

- Miner payouts go directly into Bitcoin wallets, not bank accounts.

- Exchanges are licensed by Iran’s Central Bank. Over 90 domestic exchanges now operate legally, converting Bitcoin into other cryptocurrencies or stablecoins like USDT.

- International transfers happen through intermediaries: shell companies in the UAE, crypto-to-crypto swaps on Binance, and TRON-based stablecoin bridges.

- Final destination: Iranian importers buy medicine, food, and machinery from Turkey, India, or Russia using these funds-bypassing Western payment systems entirely.

In August 2022, Iran completed its first official import using cryptocurrency: $10 million worth of medical equipment. That was a milestone. It proved the system worked at a state level.

Who’s Really in Charge?

This isn’t a free-market experiment. It’s a state-run operation with military backing. The IRGC controls the biggest mining farms. Religious foundations like Astan Quds Razavi-once known for managing shrines and charities-are now major crypto players. Licenses are handed out not to the highest bidder, but to those with political ties.

Independent miners exist, but they’re squeezed. They pay higher electricity rates, struggle to get hardware, and face random shutdowns. Meanwhile, IRGC-linked farms get priority power, protection from regulators, and direct access to international crypto gateways.

That’s why Elliptic and Chainalysis report that over $8 billion in Bitcoin transactions since 2018 have been traced to Iranian entities using Binance. The money isn’t hidden-it’s laundered through layers of exchanges, mixing services, and non-KYC platforms.

How It Compares to Other Sanctioned Nations

Venezuela tried with the Petro-a government-backed crypto token. It failed. No one trusted it. North Korea stole crypto through hacks. Iran didn’t steal. It mined. Legally. And that’s the difference.

Russia started mining after its own sanctions in 2022, but it’s still playing catch-up. Iran had seven years to build infrastructure, train operators, and create legal loopholes. By 2025, Iran had over 10,000 licensed mining farms. Russia had under 3,000.

Iran’s system is also more integrated. It doesn’t just mine. It connects to a parallel trade network: 320 tankers in its "dark fleet" move oil to buyers who pay in crypto. It’s not one tool-it’s a full ecosystem.

The Costs: Blackouts, Inequality, and Risk

But it’s not all smooth sailing. Iran’s power grid is crumbling. In summer 2024, cities like Tehran and Isfahan faced rolling blackouts because mining farms were sucking up too much electricity. Hospitals ran on backup generators. Factories shut down. Ordinary Iranians paid higher electricity bills while state-linked miners used free power.

There’s also the human cost. The money from mining doesn’t reach the people. It funds missile programs, proxies in Yemen and Lebanon, and elite security units. Meanwhile, inflation hits 40%, and salaries can’t keep up.

And then there’s the risk. Every Bitcoin transaction leaves a trail. Blockchain analytics firms like TRM Labs and Elliptic track Iranian-linked wallets. The U.S. Treasury has sanctioned over 40 Iranian crypto entities since 2020. Exchanges that unknowingly process Iranian funds risk fines or being cut off from global banking.

Still, Iran keeps going. Why? Because the alternative is worse.

What’s Next? The Future of Sanctions and Crypto

Iran’s model is being watched closely. Countries like Venezuela, Syria, and even North Korea are studying it. If sanctions remain, more nations will follow suit.

But the world is responding. The U.S. and EU are pushing for better blockchain monitoring tools. The Financial Action Task Force (FATF) is drafting new rules to flag high-risk mining jurisdictions. Some exchanges now block Iranian IPs. Others argue that’s impossible-Bitcoin’s design makes geographic blocking pointless.

One thing’s clear: traditional sanctions are losing their grip. When you can generate your own currency using your own resources, you don’t need the dollar. Iran proved that. And now, the rest of the world has to decide: do you shut down mining farms? Or do you accept that the rules have changed?

For now, Iran keeps mining. The rigs hum. The power flows. The Bitcoin piles up. And the world watches-because this isn’t just about Iran. It’s about the future of money itself.

Manish Gupta

September 9, 2025 AT 13:58Gabrielle Loeser

September 9, 2025 AT 13:59Cyndy Mcquiston

September 9, 2025 AT 14:00Abby Gonzales Hoffman

September 9, 2025 AT 14:02Rampraveen Rani

September 9, 2025 AT 14:03ashish ramani

September 9, 2025 AT 14:04Natasha Nelson

September 9, 2025 AT 14:06Sarah Hannay

September 9, 2025 AT 14:07Richard Williams

September 9, 2025 AT 14:08Prabhleen Bhatti

September 9, 2025 AT 14:10Elizabeth Mitchell

September 9, 2025 AT 14:11Chris Houser

September 9, 2025 AT 14:12William Burns

September 9, 2025 AT 14:14Ashley Cecil

September 9, 2025 AT 14:15John E Owren

September 9, 2025 AT 14:16Joseph Eckelkamp

September 9, 2025 AT 14:18