27

Iran's Crypto Strategy for International Trade: How Tehran Bypasses Sanctions

Iran Crypto Strategy Impact Calculator

- Global BTC Share ~5%

- Users on Nobitex 11M+

- Annual Mining Revenue $4.18B

- Hack Loss (Nobitex) $90M

Estimated Economic Impact

Enter values and click "Analyze Impact" to see results.

Risk Assessment

Risk level will appear here after calculation.

Regulatory Compliance

Compliance considerations will appear here after calculation.

Energy Strain: Mining operations consume significant national resources.

Security Vulnerability: High-profile hacks can disrupt entire systems.

Sanctions Evasion: Crypto provides alternative pathways around traditional banking.

International Pressure: Enforcement agencies track blockchain transactions closely.

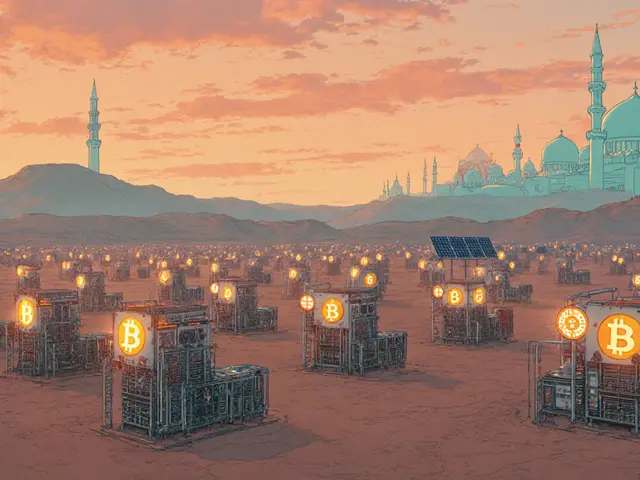

When you hear about a country trying to beat sanctions with digital money, Iran instantly pops up. The Iran cryptocurrency strategy has turned the nation into a case study for how a state can weaponize blockchain to keep trade arteries open. Below we unpack the whole system - from massive Bitcoin farms to the high‑profile Nobitex breach - and show why businesses and regulators are watching every move.

Key Takeaways

- Iran built a state‑backed crypto ecosystem that produced ~5% of global Bitcoin in 2021.

- Central Bank directives in early 2025 forced exchanges to shut Rial gateways, tightening domestic control.

- Nobitex, with >11million users, became the linchpin of Iran’s sanctions‑evasion network before a $90million hack rattled the system.

- U.S. OFAC traced a $600million shadow banking chain that moved oil‑sale proceeds through Ethereum and Tron wallets.

- Energy strain, regulatory crackdowns, and security breaches are now limiting the strategy’s effectiveness.

Why Iran Turned to Crypto

International sanctions have choked Iran’s ability to use traditional banking channels. With oil revenues frozen and the rial losing value, Tehran needed a way to move cash across borders without attracting the watchful eyes of the U.S. Treasury or the EU. Digital assets offered three clear advantages:

- Borderless transfers that bypass correspondent banks.

- Anonymity layer (when paired with mixers or privacy‑focused coins) that can mask the ultimate beneficiary.

- Potential to monetize domestic energy surplus through Bitcoin mining.

By early 2021, Iran’s Bitcoin mining operations that used cheap natural‑gas power to generate new bitcoins, accounting for roughly five percent of global hash power. were humming at scale, creating a digital reserve that could be swapped for foreign currency on the black market.

Regulatory Shifts in 2025

The Central Bank of Iran (CBI the country’s monetary authority that oversees all financial activity, including crypto licensing and transaction monitoring.) issued a sweeping directive in February 2025. Its main points were:

- Close all Rial payment gateways for crypto exchanges - the CBI claimed billions in daily volume were evading taxes.

- Require a state license for any mining farm, exchange, or wallet service.

- Ban the use of crypto for domestic payments while legalizing crypto‑based imports as a sanctions‑evasion tool.

These moves were meant to tighten the government’s grip, but they also signaled to the world that Tehran was institutionalizing crypto as a foreign‑exchange lifeline.

Core Pillars of the Ecosystem

Three components formed the backbone of Iran’s strategy:

1. State‑Supported Mining Farms

Licenses were handed out to more than 10,000 farms by 2022. The farms tapped into Iran’s abundant natural‑gas fields, converting waste energy into hash power. The result? By 2024, an estimated $4.18billion worth of crypto had left Iran, a 70% jump from the previous year.

2. The Dominant Exchange - Nobitex

At the center sat Nobitex (Nobitex Iran’s largest cryptocurrency exchange, serving over 11million users and acting as the primary conduit for converting crypto into usable foreign currency.). Blockchain‑intelligence firm Elliptic linked the platform to wallets tied to the Islamic Revolutionary Guard Corps (IRGC). The exchange’s dominance made it a prime target, and on June 18, 2025 a massive exploit drained more than $90million across Bitcoin, Ethereum, and USDT.

3. Shadow Banking Networks

OFAC’s September 2025 sanctions revealed a hidden web of front companies and crypto wallets that funneled at least $100million from oil sales into Ethereum and Tron addresses controlled by ArashEstakiAlivand. This intricate chain spanned multiple jurisdictions and blended fiat‑based shell firms with on‑chain transactions, illustrating how digital money can mask traditional sanctions‑evasion tactics.

Table: 2025 Regulatory Actions vs. Market Impact

| Regulatory Action | Intended Goal | Observed Impact |

|---|---|---|

| Closure of Rial gateways | Prevent tax‑evading crypto flows | Exchange volume shifted to offshore p2p platforms; illicit transfers rose 22% |

| Mandatory licensing for miners | Centralize control, monitor energy use | Licensing bottleneck slowed farm expansion; underground “gray‑miner” ops increased |

| Legalizing crypto for import payments | Facilitate essential goods procurement | Importers used crypto to bypass SWIFT; however, volatility added cost spikes of up to 15% |

Vulnerabilities Exposed in 2025

The strategy looked slick on paper, but two major cracks emerged:

- Energy strain: Mining ate up a sizable share of the national grid, prompting rolling blackouts that hurt both industry and households.

- Security flaws: The Nobitex hack proved that a single breach could cripple the entire sanctions‑evasion pipeline, forcing traders to scramble for alternative (often less regulated) routes.

When the $90million loss hit, many Iranian businesses faced frozen crypto assets, prompting a wave of panic withdrawals and a temporary slowdown in cross‑border trade.

International Enforcement & Blockchain Intelligence

Agencies aren’t blind to Iran’s moves. The U.S. Office of Foreign Assets Control (OFAC the U.S. Treasury office that administers and enforces economic and trade sanctions against targeted foreign countries.) has been tracking wallets with the help of firms like Chainalysis and Elliptic. Their on‑chain forensics combine transaction graphs, IP‑level data, and geopolitical context to flag suspicious flows. The September 2025 $600million sanction package was a direct result of this collaborative intel.

At the same time, the European Union’s sanctions‑monitoring unit raised alerts on Iranian crypto activity, urging banks to flag any counterparties linked to the IRGC‑Quds Force. This layered pressure is forcing Tehran to reconsider the cost‑benefit of its crypto gamble.

What It Means for Global Businesses

If you’re a trader, importer, or fintech firm eyeing the Iranian market, the landscape now feels like walking a minefield:

- Compliance risk: Engaging with any Iranian‑linked wallet can trigger secondary sanctions.

- Liquidity challenge: With major exchanges under scrutiny, finding reliable counter‑parties for fiat‑crypto swaps is harder.

- Operational friction: The CBI’s licensing regime means any on‑ground partner must prove state approval, a process that can take months.

Many firms are now opting for third‑party intermediaries in friendly jurisdictions, but that adds cost and still carries sanction‑evasion flags.

Future Outlook - Will Crypto Keep Iran Afloat?

Looking ahead, three scenarios are most plausible:

- Re‑tooled state crypto framework: Tehran could tighten security, shift mining to gas‑rich regions, and create a state‑run exchange with stricter KYC to appease regulators. This would restore some stability but reduce the anonymity that originally attracted illicit users.

- Full rollback: If energy shortages worsen and international pressure intensifies, the government might shut down mining and focus on barter‑based trade, abandoning crypto altogether.

- Hybrid model: Iran could maintain a limited crypto channel for essential imports while expanding the use of stablecoins pegged to non‑USD currencies, sidestepping some sanctions loopholes.

Regardless of the path, the lesson is clear: blockchain offers powerful workarounds, but it also leaves a digital trail that sophisticated enforcement agencies can follow.

Frequently Asked Questions

How much Bitcoin does Iran actually mine?

At its peak in 2021, Iran’s mining farms contributed roughly five percent of the world’s newly minted Bitcoin, thanks to cheap natural‑gas power and a large number of licensed farms.

What was the impact of the June 2025 Nobitex hack?

The exploit wiped out more than $90million across several digital assets, temporarily freezing a large chunk of Iran’s crypto‑based trade funds and forcing traders to hunt for alternative, riskier channels.

Can foreign companies legally trade crypto with Iranian partners?

Most Western jurisdictions consider any transaction that benefits the IRGC or evades sanctions illegal. Engaging with Iranian‑linked wallets can trigger secondary sanctions, so most reputable firms avoid direct crypto deals.

Why does the Central Bank of Iran still allow crypto for imports?

Imports are a lifeline for essential goods. By permitting crypto payments for imports, Tehran can sidestep blocked SWIFT routes while keeping the transaction flow under state oversight.

What role do blockchain‑intelligence firms play?

Companies like Chainalysis and Elliptic analyze on‑chain data, link wallet activity to real‑world entities, and provide alerts that regulators use to freeze assets and sanction networks.

Kate Roberge

August 27, 2025 AT 18:00Seems like every time Iran tries to get clever with crypto, the world just pats them on the back for “innovation” while ignoring the real cost. Their mining farms guzzle natural gas that could power hospitals, and the whole “sanctions‑busting” narrative feels like a propaganda stunt. The Nobitex hack? A textbook example of why you shouldn’t put all your eggs in a state‑run basket. And yet regulators keep calling it a “strategic advantage.” Give me a break. The energy strain alone should be enough to shut the whole operation down, but the government keeps digging its heels in, hoping the blockchain will magically solve a geopolitical mess. Bottom line: crypto isn’t a miracle cure for sanctions; it’s just a new front in an old battle.

Oreoluwa Towoju

August 29, 2025 AT 20:00It’s impressive how they’ve turned wasted gas into mining power, but the hack shows the fragility of concentrating assets. Diversifying beyond a single exchange could raise resilience.

Sidharth Praveen

August 31, 2025 AT 22:00Honestly, I think Iran’s move into crypto shows a certain grit. Leveraging cheap energy for mining is smart, and even with the recent setbacks they’re learning fast. If they can tighten security and spread operations, they could keep a steady stream of foreign currency without relying on traditional banks.

Sophie Sturdevant

September 3, 2025 AT 00:00From a fintech perspective, the architecture they’ve built is a hybrid on‑ramps/off‑ramps model with embedded KYC layers. The regulatory crackdown adds a compliance overlay, but the core protocol remains resilient. Scaling will require robust node distribution and fault‑tolerant smart‑contract gateways.

Nathan Blades

September 5, 2025 AT 02:00Picture this: a nation that once stared at a blacked‑out grid now feeds the global hash rate-kind of heroic, right? Yet every hero meets a dragon, and the Nobitex breach was that fire‑breathing beast. The lesson? Turn that pain into purpose. By decentralizing mining pods across remote gas fields, they can hedge against single‑point failures and keep the crypto lifeline pulsing.

Somesh Nikam

September 7, 2025 AT 04:00What really stands out is the human element behind these numbers 😊. The miners are often local communities hoping for steady income, and when a hack hits, it’s not just a ledger error-it’s families feeling the pinch. Strengthening multi‑factor authentication and community education can bridge that gap and restore trust.

Jan B.

September 9, 2025 AT 06:00Iran’s crypto push is a clear case of adaptation under pressure. By using domestic energy they reduce reliance on foreign fuel and keep some financial flow alive. However the centralization around one exchange creates a bottleneck that regulators can target.

MARLIN RIVERA

September 11, 2025 AT 08:00Another vanity crypto stunt that will implode.

Debby Haime

September 13, 2025 AT 10:00Even with the hack, the underlying strategy of using crypto for import payments is clever. It sidesteps SWIFT delays and gives businesses a quicker way to settle invoices, especially for essential goods.

emmanuel omari

September 15, 2025 AT 12:00The West loves to blame Iran for “sanctions evasion” while ignoring their own sanctions regimes that cripple economies. Crypto is just another tool they’ll try to demonize, but the tech itself is neutral.

Andy Cox

September 17, 2025 AT 14:00yeah the whole thing shows how crypto can be a double edged sword for countries under pressure it offers freedom but also opens doors for hacks

Courtney Winq-Microblading

September 19, 2025 AT 16:00Imagine the blockchain as a river flowing through a desert; it can bring life or erode the banks. Iran’s experiment is a vivid illustration of that paradox, where the promise of financial oasis meets the harsh reality of security drought.

katie littlewood

September 21, 2025 AT 18:00When I first read about Iran’s crypto push, I thought it was just another headline about sanctions and digital gold, but the deeper you dig, the more layers you uncover, each more fascinating than the last. First, there’s the sheer audacity of converting wasted natural‑gas flares into a mining powerhouse that accounts for roughly five percent of global Bitcoin production, a feat that would make any tech‑savvy CEO raise an eyebrow. Then, the central bank’s decision to shut Rial gateways while simultaneously legalizing crypto for import payments creates a paradoxical regulatory landscape that feels like a sandbox for innovators and risk‑takers alike. The dominance of Nobitex, with its eleven‑million‑strong user base, illustrates how a single platform can become the lifeline of an entire nation’s foreign‑exchange strategy, yet also a single point of catastrophic failure, as the $90 million hack so dramatically showed. Energy consumption, another critical factor, has strained Iran’s grid to the point where rolling blackouts have become a daily inconvenience for ordinary citizens, reminding us that the environmental cost of mining is not a trivial footnote. Moreover, the shadow banking networks that funnel oil‑sale proceeds through Ethereum and Tron wallets reveal a sophisticated blending of traditional finance and decentralized assets, blurring the lines for regulators who are still catching up. International enforcement agencies, armed with on‑chain analytics from firms like Chainalysis, have proven that you cannot hide forever on the blockchain, as the $600 million sanction package demonstrated. Yet, despite these pressures, there is a palpable sense of resilience among the miners and traders who adapt, diversify, and keep the crypto currents flowing. The prospect of a state‑run exchange with stricter KYC could stabilize operations, but it might also dilute the very anonymity that initially attracted participants. On the other hand, a full rollback could see Iran return to barter systems, which, while less tech‑heavy, would sacrifice the speed and breadth that digital assets provide. A hybrid model, perhaps employing stablecoins pegged to non‑USD currencies, could strike a balance between compliance and flexibility, offering a middle ground that satisfies both the government and the market. As each scenario unfolds, one constant remains: blockchain leaves a digital trail, and that trail can either be a breadcrumb for growth or a red flag for sanctions enforcers. Ultimately, the lesson here is that technology alone cannot solve geopolitical challenges; governance, security, and sustainable energy policies must evolve in tandem. Whether Iran continues to ride this crypto wave or decides to dock, the world will be watching, learning, and perhaps adopting similar strategies in their own contexts. In short, the Iran crypto saga is less about the coins themselves and more about the complex dance between power, necessity, and innovation.

Jenae Lawler

September 23, 2025 AT 20:00While many laud Iran’s foray into digital assets as a testament to resilience, one must acknowledge that such endeavors merely perpetuate a superficial veneer of modernity, masking the underlying economic fragilities that no blockchain can rectify.

Chad Fraser

September 25, 2025 AT 22:00Hey folks, if Iran can pivot and keep the trade wheels turning with crypto, there’s hope for any sanctioned economy looking for a creative lifeline.

Jayne McCann

September 28, 2025 AT 00:00Crypto isn’t a magic bullet, it’s just another tool.

Richard Herman

September 30, 2025 AT 02:00Seeing the interplay between energy policy and digital finance in Iran offers a valuable case study for other nations balancing sovereignty with global pressure.

Parker Dixon

October 2, 2025 AT 04:00It’s fascinating how blockchain analytics can turn a covert network into a transparent ledger 📊. The key for any country is to invest in security measures while still harnessing the efficiency gains crypto offers. 🌍

Stefano Benny

October 4, 2025 AT 06:00From a DeFi perspective, Iran’s state‑run exchange is a centralized liquidity hub that undermines the core tenets of decentralization-still, it serves as a pragmatic bridge in a high‑risk compliance environment. ⚡️

Bobby Ferew

October 6, 2025 AT 08:00The emotional toll on users after the Nobitex breach was palpable; trust erosion can cascade into market volatility, highlighting the need for robust custodial solutions and transparent governance frameworks.

celester Johnson

October 8, 2025 AT 10:00One could argue that Iran’s crypto gamble is less about circumventing sanctions and more about asserting technological sovereignty in a world that often discounts non‑Western innovation.