Crypto Detection: Spotting Scams, Fake Airdrops, and Real Opportunities

When you hear about a free crypto airdrop, a distribution of free tokens meant to grow a project’s user base. Also known as token giveaway, it can be a real way to get started in crypto—or a clever trap designed to steal your private key. Most of the time, it’s the latter. Crypto detection isn’t about fancy tools or complex algorithms. It’s about asking the right questions before you click, connect your wallet, or send any crypto. The market is flooded with fake projects, ghost teams, and bots pretending to be legitimate. If it sounds too good to be true, it is—and crypto detection is how you prove it.

Real blockchain fraud, illegal activity that exploits trust in decentralized systems, often through fake tokens or phishing. Also known as crypto scam, it thrives on speed and confusion. Scammers don’t need to hack your wallet. They just need you to sign a malicious transaction or enter your seed phrase on a fake site. Look at the posts below: ECIO, WELL, Zenith Coin, HyperGraph—none of these had real airdrops. But hundreds of people still lost money chasing them. Why? Because they didn’t know how to detect the red flags: no team info, no audit, no community, no history. Meanwhile, real opportunities like the AceStarter x CoinMarketCap NFT airdrop had clear rules, limited supply, and verifiable winners. Crypto detection means learning to tell the difference.

It’s not just about airdrops. Fake exchanges like Turtle Network DEX and InfinityCoin promise high returns but vanish without audits or trading volume. Privacy tokens like PRIVIX claim anonymity but have zero community. Even legitimate concepts like DePIN or Web3 get twisted into pump-and-dump schemes. Crypto detection helps you see through the noise. You don’t need to be a coder. You need to check: Is there a public team? Is the contract audited? Does the project update regularly? Is the airdrop tied to a known platform like CoinMarketCap—or just a random website? These aren’t guesswork. They’re patterns. And once you learn them, you stop being a target.

Below, you’ll find real cases of crypto detection in action—how scams were exposed, how real projects stood out, and what you can do today to protect your assets. No theory. No fluff. Just what worked, what didn’t, and why it matters right now.

2

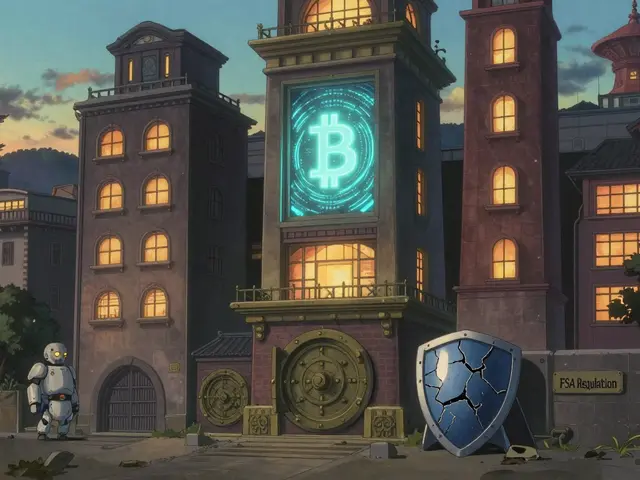

Offshore Crypto Accounts: How Authorities Detect Them and What Happens If You Get Caught

Offshore crypto accounts are no longer hidden. Advanced blockchain tracking, global regulations, and sanctions make detection almost guaranteed. Learn how authorities find them and the real legal risks you face in 2025.

Latest Posts

Popular Posts

Tags

- decentralized exchange

- crypto exchange

- crypto exchange review

- cryptocurrency

- crypto airdrop 2025

- CoinMarketCap airdrop

- blockchain

- meme cryptocurrency

- GENIUS Act

- cryptocurrency compliance

- crypto airdrop

- meme coin

- crypto trading

- fake crypto exchange

- Solana meme coin

- cryptocurrency valuation

- Binance Smart Chain

- underground crypto Nepal

- crypto airdrop guide

- crypto staking