Sanctions Circumvention in Crypto: How It Works and What You Need to Know

When people talk about sanctions circumvention, the act of bypassing government financial restrictions using alternative systems like cryptocurrency. Also known as crypto evasion, it’s not about hiding money—it’s about moving it where traditional banks can’t touch it. This isn’t theoretical. In countries like Iran and Russia, traders use crypto to buy essentials when banks are locked down. In Europe and the U.S., regulators are scrambling to keep up as wallets and DeFi protocols become invisible to old-school monitoring tools.

EU sanctions, a set of financial restrictions enforced by the European Union against specific individuals, entities, and nations. Also known as EU financial restrictions, it directly impacts crypto platforms operating in or serving EU residents. The MiCA regulation and TFR (Travel Rule) force exchanges to collect and share user data—but what happens when someone uses a non-KYC DEX on Arbitrum or a peer-to-peer swap on LocalCryptos? That’s where crypto compliance, the process of following legal rules when handling digital assets to avoid penalties or shutdowns. Also known as crypto AML, it gets messy. Platforms that ignore these rules risk fines, freezing, or outright bans. But users? They’re just trying to access markets, pay for services, or send money home.

financial crime, illegal activity involving money, including money laundering, sanctions evasion, and terrorist financing. Also known as illicit finance, it is the main reason governments are pushing for global crypto tracking. The Crypto-Asset Reporting Framework (CARF) and CRS 2.0 are designed to force exchanges to report user activity to tax and law enforcement agencies. But here’s the catch: most of the real circumvention happens on chains like Optimism or TON, where fees are low and identity checks are optional. That’s why posts about KyberSwap on Optimism, Velodrome Finance, and BB EXCHANGE keep popping up—they’re not just trading platforms. They’re part of a larger system where compliance meets reality.

What you’ll find in this collection isn’t a list of shady tools. It’s a map of where crypto actually moves when borders and banks draw lines. You’ll see how Iranian traders use VPNs to access exchanges, how small nations shape rules differently than the U.S. or EU, and why a token like VIDZ vanished—not because it was a scam, but because its creators couldn’t survive the regulatory squeeze. Some of these platforms are legit. Others are gray. All of them are telling you something: the old system isn’t working for everyone.

There’s no magic fix. If you’re using crypto to avoid sanctions, you’re playing with fire. If you’re running a platform, you’re walking a tightrope. But understanding how it works—really works—is the only way to stay safe, stay legal, or at least know what you’re up against. The posts below don’t judge. They show you what’s out there, who’s behind it, and what the risks really look like.

9

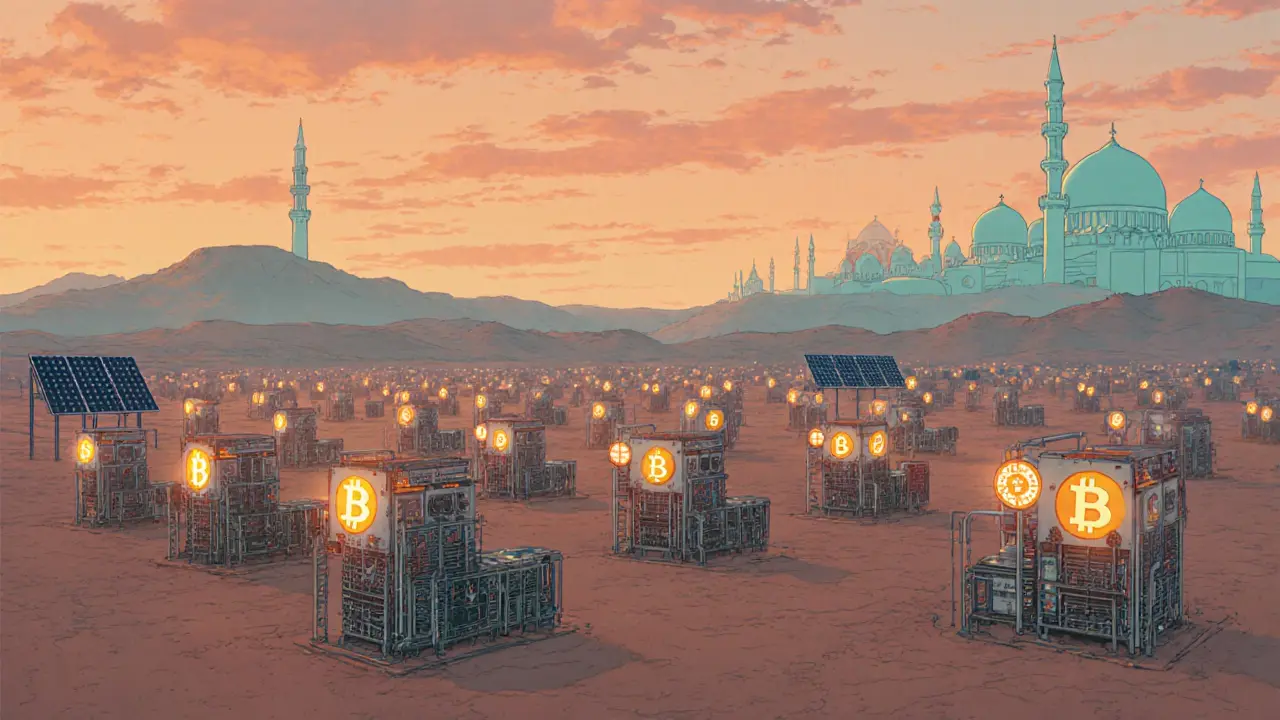

How Iran Uses Bitcoin Mining to Bypass International Sanctions

Iran uses its cheap energy and state-backed infrastructure to mine Bitcoin at scale, bypassing international sanctions by converting electricity into hard currency without relying on Western banks or payment systems.

Latest Posts

Popular Posts

Tags

- decentralized exchange

- crypto exchange

- crypto exchange review

- cryptocurrency

- crypto airdrop 2025

- CoinMarketCap airdrop

- blockchain

- meme cryptocurrency

- GENIUS Act

- cryptocurrency compliance

- crypto airdrop

- meme coin

- crypto trading

- fake crypto exchange

- Solana meme coin

- cryptocurrency valuation

- Binance Smart Chain

- underground crypto Nepal

- crypto airdrop guide

- crypto staking