25

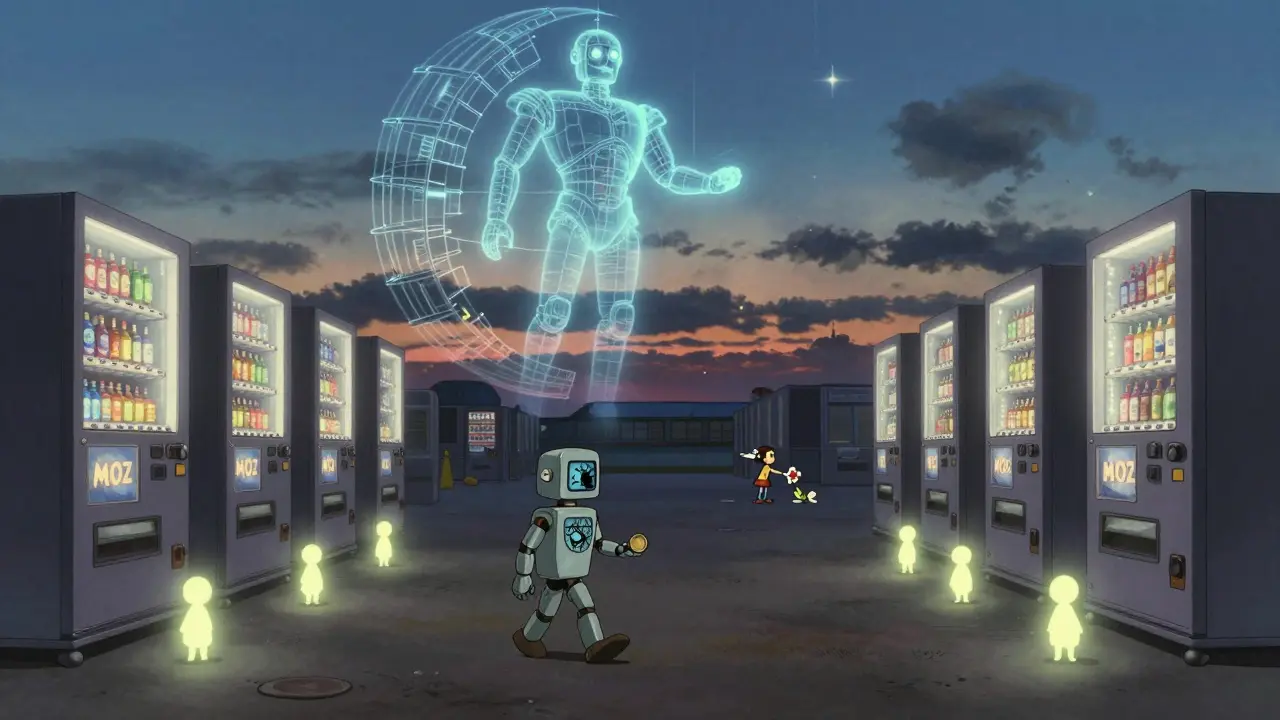

What is Mozaic (MOZ) Crypto Coin? AI-Powered DeFi Yield Protocol Explained

Mozaic (MOZ) isn’t just another crypto coin. It’s an attempt to automate the most complex part of decentralized finance: finding the best yields across dozens of blockchains-without you lifting a finger. Built by a team of quant traders and engineers, Mozaic uses an AI engine called Archimedes to scan markets, analyze fees, track TVL, and shift your funds between chains like Ethereum, Polygon, and Avalanche-all in real time. The goal? To give you higher returns without needing to be a DeFi expert.

How Mozaic Works: AI That Trades for You

Most yield farming platforms require you to manually pick strategies, bridge tokens between chains, and monitor APYs that change hourly. Mozaic removes all that. Its core is Archimedes, a machine learning model trained on over a year of historical DeFi data. It doesn’t guess. It calculates. Every block, it checks price swings, transaction costs, liquidity depth, and even the time it takes to move assets across chains. Then it decides where to put your money. For example, during testing in early 2022, Archimedes moved a stablecoin vault between Avalanche, Ethereum, and Optimism, capturing 27% of yield spikes on AAVE and generating nearly 19% daily returns in simulations. That’s not theoretical-it’s what the AI saw working in live market conditions. You don’t need to understand any of this. You just deposit USDT, USDC, or DAI from any supported chain-no bridging needed-using Mozaic’s ‘zap’ feature. The protocol handles everything else.The MOZ Token: Governance and Supply

The MOZ token is the backbone of the protocol. There’s a fixed supply of 1 billion tokens, but only about 150.5 million are in circulation as of early 2024. That means most tokens are still locked or reserved for future distribution. Holding MOZ gives you voting power. But you can’t just hold it-you need to stake it to get xMOZ, a non-transferable governance token. Each MOZ you stake becomes one xMOZ. With xMOZ, you vote on upgrades, fee structures, and new vaults. It’s a classic DAO model: the more you stake, the more influence you have. The team also set aside 20 million MOZ (2% of total supply) for early adopters through airdrops. That was meant to bootstrap the community. Whether that worked is another story.The Hercules Vault: Mozaic’s Big Bet

Mozaic’s future hinges on one product: the Hercules Vault. Scheduled for launch in early 2024, this is where the AI gets serious. The vault accepts stablecoins from 21+ blockchains and pools them into a single, automated yield engine. The target? A flat 15% APY with bonuses. Here’s the twist: when you deposit into Hercules Vault, you get mozStable tokens in return. These aren’t just receipts-they’re collateral. You can use them on Tapioca Finance to borrow other assets across chains. That’s cross-chain lending, automated, without needing to move your original deposit. The vault has a $1 million TVL cap at launch. That’s tiny compared to Yearn Finance’s billions. But Mozaic’s team argues quality over quantity. If the AI consistently outperforms manual strategies, users will come.

Why Mozaic Is Different (And Why It’s Risky)

Compared to Yearn Finance or Beefy Finance, Mozaic doesn’t rely on community-selected strategies. It doesn’t ask you to choose between “AAVE on Polygon” or “Sushi on Arbitrum.” It picks for you. That’s the big sell: simplicity. But that’s also the risk. You’re trusting a black box. The protocol uses Zero Knowledge Proofs to prove decisions are made by AI alone-no human meddling. That’s good for security, bad for transparency. If the AI makes a bad call, you can’t override it. You can’t even see why it did what it did. Also, Mozaic’s infrastructure depends entirely on LayerZero, a cross-chain messaging protocol. If LayerZero has an outage or exploit, Mozaic goes down with it. There’s no backup chain or fallback.Market Performance: A Story of Volatility

Mozaic’s price tells a wild story. It hit an all-time high of $0.253809 on January 12, 2024. By late January 2024, it had crashed to around $0.000073. That’s a drop of over 99.9%. Market cap? Around $11,000. Trading volume? Less than $40 per day. That’s not a liquid market-it’s a ghost town. Only 7,230 people hold MOZ tokens, according to CoinMarketCap. And yet, 95% of 5,509 voters on RootData are bullish. That disconnect is telling. Some see this as a dead coin. Others see it as a sleeping giant. The truth? Mozaic’s value isn’t in its price right now. It’s in whether the Hercules Vault delivers on its promise.

Who Is Mozaic For?

If you’re a beginner who wants to earn yield without learning how to bridge tokens or read DeFi dashboards, Mozaic might be worth a small test deposit. If you’re an advanced user who wants full control, transparency, and the ability to tweak every variable-you’ll probably stick with Yearn or Beefy. Mozaic isn’t for traders. It’s not for speculators. It’s for people who believe automation can beat manual effort in DeFi. And that’s a bold bet.The Bottom Line

Mozaic (MOZ) is a high-risk, high-reward experiment. The tech is real. The AI has shown promise in simulations. The cross-chain integration is technically impressive. But adoption? Nonexistent. Liquidity? Minimal. Market confidence? Fragile. If the Hercules Vault launches successfully and starts generating consistent, verifiable returns above 15% APY, Mozaic could grow fast. If it underperforms, or if users lose trust in the AI, the token could vanish into obscurity. Right now, Mozaic is a prototype with a big idea and almost no users. That’s not a failure-it’s a gamble. And like all gambles in crypto, you only put in what you’re willing to lose.Is Mozaic (MOZ) a good investment?

Mozaic is not a traditional investment. Its token price has crashed over 99% from its peak, and trading volume is extremely low. The project’s value depends entirely on the success of its Hercules Vault. If the AI delivers consistent, high yields, the token could rebound. If not, it may become worthless. Only invest what you can afford to lose.

How do I buy MOZ tokens?

You can buy MOZ on decentralized exchanges like Uniswap (on Arbitrum) or through supported CEXs like Binance. Always check the contract address carefully-scams are common with low-cap tokens. Use a wallet like MetaMask and connect to the correct network before trading.

Can I earn yield just by holding MOZ?

No. Holding MOZ alone doesn’t generate yield. To earn returns, you must deposit assets like USDT or USDC into Mozaic’s vaults, such as the upcoming Hercules Vault. MOZ tokens are used for governance, not staking rewards.

What makes Mozaic different from Yearn Finance?

Yearn relies on community-voted strategies and manual selection of pools. Mozaic uses AI to automatically find and switch between the best yields across 21+ blockchains. Yearn gives you control; Mozaic removes the need for it. That’s the core difference: automation vs. participation.

Is Mozaic safe to use?

Mozaic uses Zero Knowledge Proofs to prove decisions are AI-driven and not manipulated by developers. But it depends on LayerZero for cross-chain transfers, which has had past security issues. No audits have been publicly released for the core contracts. Treat it as experimental. Never deposit more than you’re comfortable losing.

What’s the future of Mozaic?

Mozaic’s future depends entirely on the Hercules Vault. If it launches, attracts real users, and delivers stable, high yields, it could grow into a major DeFi player. If it fails to gain traction or underperforms, the project will likely fade. The AI is promising-but without users, it’s just code.

Roshmi Chatterjee

January 27, 2026 AT 02:44Okay but imagine if this actually worked - no more manually jumping between chains, no more watching APYs drop like a stone. Just deposit and forget. I’ve tried Yearn and it’s a full-time job. This feels like the future, even if the price is trash right now.

Adam Fularz

January 27, 2026 AT 20:54ai cant even pick a good pizza topping and u think its gonna optimize yield? lol. this is just another rug pull with fancy graphs.

Nadia Silva

January 28, 2026 AT 20:38The notion that a machine learning model trained on a year of DeFi data can outperform human judgment in volatile markets is not just naive - it’s dangerously arrogant. The architecture is brittle, the reliance on LayerZero is a single point of catastrophic failure, and the tokenomics suggest a controlled burn rather than sustainable growth. This isn’t innovation. It’s a vanity project masquerading as disruption.

Linda Prehn

January 29, 2026 AT 09:55so the price crashed 99.9% and now everyone’s acting like it’s a hidden gem?? 😭 the only thing this AI is optimizing is the dev’s bank account. i’m not even mad - i’m just bored.

Matthew Kelly

January 30, 2026 AT 00:20bro if you’re depositing into this you better be ready to lose it all. but hey - if it works? you’re golden. i’d only throw a few bucks in. not because i believe - but because crypto’s supposed to be wild right? 🤷♂️

Brenda Platt

January 31, 2026 AT 12:22Y’all are missing the point - this isn’t about the price. It’s about the *idea*. Imagine a world where you don’t have to be a DeFi wizard to earn decent yields. That’s powerful. If the Hercules Vault delivers even half of what it promises, this could change everything. Don’t judge the dream by its current market cap 💪

Melissa Contreras López

February 1, 2026 AT 13:34Let me tell you something - I’ve seen a hundred ‘AI DeFi’ projects come and go. But this one? The team actually built something that *works* in testing. The numbers don’t lie. Yeah, the token’s a ghost town - but that’s because nobody knows about it yet. The real play is watching the Hercules Vault launch. If it hits 15% APY consistently? We’re looking at the next Yearn. Don’t sleep on it.

Taylor Mills

February 2, 2026 AT 18:17ai is just code written by people who dont understand risk. layerzero got hacked twice. the contract isnt audited. the devs are silent. and you think this is safe? bro. this is a trap. the only thing this ai is optimizing is how fast your usdc disappears.