10

Alien (ALIEN) Crypto Coin Explained: Definition, Tokenomics & How to Buy

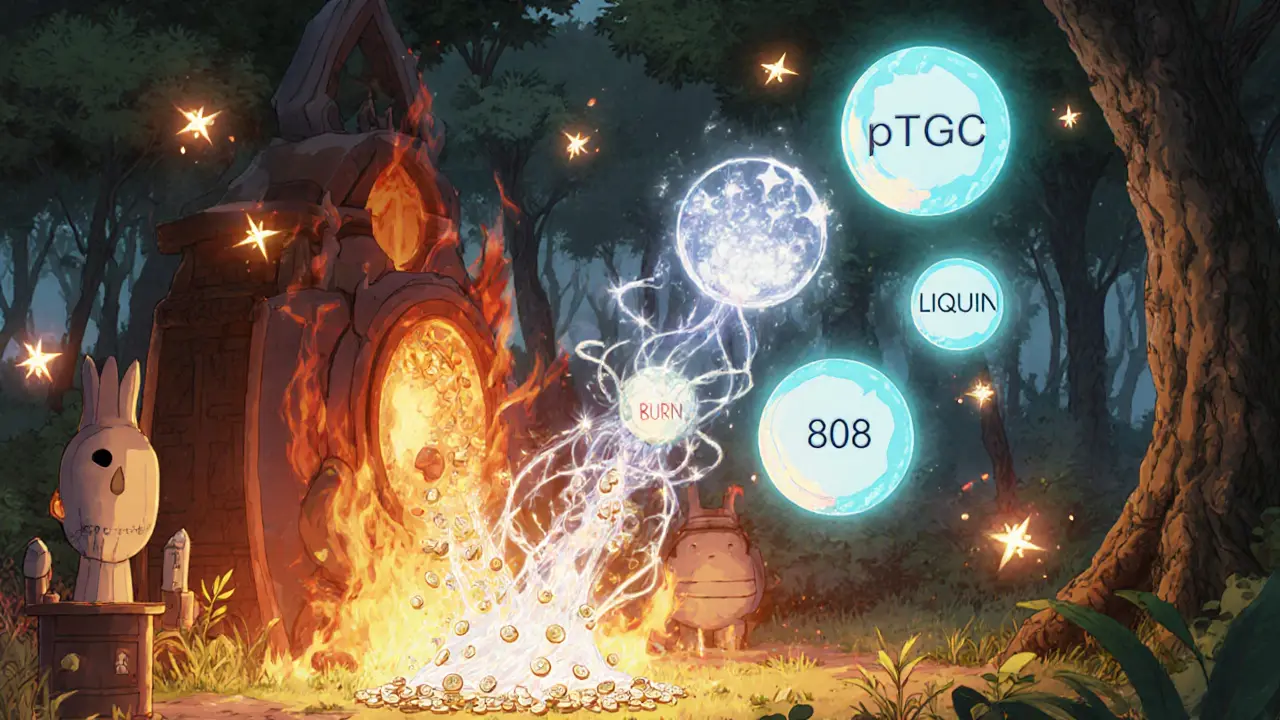

Alien (ALIEN) Token Burn Calculator

Token Information

Alien (ALIEN) is a meme token with a 1% burn mechanism. Each transaction includes a 1% burn tax and 4% tax for purchasing pTGC and amplifiers.

Key Takeaways

- Alien crypto is a community‑driven meme token built on the pTGC ecosystem.

- Every transaction triggers a 1% burn of ALIEN plus purchases and burns of pTGC and its three amplifiers.

- The token launched with a 1:1 airdrop to pTGC stakers, worth over $37,000 at mint.

- Price data is sparse; as of Oct2025 the token trades around $0.0036 with high volatility.

- Holding ALIEN is only rewarding if you also stake pTGC with LIQUID, BURN and 808 tokens.

What Is Alien (ALIEN) Token?

Alien (ALIEN) is a decentralized cryptocurrency token that lives inside the pTGC ecosystem. It was created as a meme‑style coin, paying homage to the community that backs pTGC. The project describes itself as “by the people, for the people,” and it relies on a purely on‑chain governance model with no central authority.

The token’s ticker, ALIEN, is shared by several unrelated projects (e.g., Alien Worlds, AlienBase), which often leads to price‑feed errors on aggregators. Despite the confusion, the official ALIEN token is tied to a set of four “amplifier” tokens-LIQUID, BURN, 808 and the base pTGC-that together shape its reward system.

Buy‑and‑Burn Mechanics Made Simple

Understanding the Buy‑and‑Burn Mechanism: a protocol that automatically purchases a token on the market and then sends it to an unspendable address is key to grasping ALIEN’s economics.

Each ALIEN transfer is taxed as follows:

- 1% of the transferred amount is used to buy back ALIEN on the open market and immediately burn it, reducing circulating supply.

- The remaining tax (typically 4%) funds three separate purchases: pTGC, LIQUID and BURN (the 808 token is bought with a portion of the BURN purchase).

- All bought tokens are also sent to their respective burn wallets, creating a layered deflationary effect.

This dual‑tax structure means that every trade not only makes ALIEN scarcer but also continuously feeds value into the broader pTGC ecosystem. Holders see their wallets grow with pTGC and its amplifiers, while ALIEN’s own supply shrinks.

How ALIEN Fits Into the pTGC Ecosystem

The pTGC tokenthe native utility token of the pTGC protocol serves as the backbone of a suite of “amplifier” tokens. These amplifiers-LIQUID, BURN and 808-are designed to multiply staking rewards and voting power within pTGC.

When you stake pTGC along with all three amplifiers, the protocol automatically airdrops an equal amount of ALIEN to your wallet. This 1:1 airdrop was valued at over $37,000 at launch, giving early participants a sizable entry point.

Because the reward stream depends on holding the full amplifier set, ALIEN effectively encourages deeper engagement with pTGC. Users who only hold ALIEN without the amplifiers receive burn benefits but miss out on the pTGC reward portion.

Recent Price Performance & Forecasts

Price data for ALIEN is fragmented. Aggregators such as BitScreener list a trading price of roughly $0.0036, representing a 16.5% weekly gain and a 9.3% rise in the last 24hours (as of early October2025). The 24‑hour range reported is $0.064675‑$0.065529, while the 7‑day range sits between $0.063678‑$0.065518. These figures appear inconsistent, suggesting either multiple tokens sharing the ALIEN ticker or simply data‑feed glitches.

The all‑time high recorded on February262024 was $0.054551, meaning the current price is roughly an 88% discount from that peak. Reported “all‑time low” data points are likely erroneous, as they reference future dates.

Forecasts vary widely:

- Digital Coin Price predicts a dip of about 17.8% in early October2025, with a 2025‑2026 price band of $0.0120‑$0.0138.

- Long‑term models (2030‑2033) foresee gradual climbs, reaching $0.0364 on average by 2033.

- BitScreener’s more aggressive scenario imagines a high of $1.58 in 2025, though that relies on massive uptake of the pTGC ecosystem.

Given the limited historical depth, any projection should be treated as speculative. The token’s value is tightly coupled to the health of pTGC and the volume of transactions that trigger the burn process.

How to Acquire and Stake ALIEN

Here’s a step‑by‑step guide for newcomers:

- Set up a non‑custodial wallet that supports Binance Smart Chain (BSC) or the specific chain where pTGC lives (most often BSC).

- Buy a modest amount of BNB (or the native chain token) to cover transaction fees.

- Visit a reputable decentralized exchange (DEX) that lists ALIEN-usually PancakeSwap or a similar BSC DEX.

- Swap BNB for pTGC first, then provide liquidity for pTGC/ALIEN pairs if you want to earn LP rewards.

- Stake your pTGC token in the official pTGC staking portal, making sure to lock all three amplifiers (LIQUID, BURN, 808) alongside it.

- Once the stake is active, the protocol automatically airdrops an equal amount of ALIEN to your address.

- Optional: Add the received ALIEN to the same liquidity pool or hold it in your wallet to benefit from future burns.

Remember that each trade incurs a 5% total tax (1% for ALIEN burn + 4% for pTGC/amplifier purchases). High tax rates can reduce short‑term profitability, so many users only trade when they anticipate a sizable price move.

Risks, Challenges, and Community Outlook

Because ALIEN is a niche token inside a relatively small ecosystem, several risk factors loom:

- Data ambiguity: Conflicting ticker symbols across platforms make price discovery difficult.

- Liquidity constraints: Low trading volume means large buy or sell orders can swing the price dramatically.

- Ecosystem dependency: If pTGC fails to attract new users, the burn and reward mechanisms lose relevance.

- Regulatory uncertainty: Meme tokens often attract scrutiny; any crackdown on tokenomics schemes could impact ALIEN.

The community is largely composed of pTGC stakers. Social signals (Telegram, Discord) show moderate enthusiasm but limited growth outside the core group. No formal roadmap has been published, so future feature releases are uncertain.

On the upside, the layered burn system aligns with broader DeFi trends where scarcity drives price appreciation. If the pTGC protocol scales-adding new dApps, forging partnerships, or expanding to other chains-ALIEN could benefit indirectly through increased transaction volume.

Frequently Asked Questions

Is Alien (ALIEN) a separate blockchain?

No. ALIEN is an ERC‑20‑style token that lives on the same network as pTGC, typically Binance Smart Chain. It does not have its own consensus layer.

How does the 1% burn affect my holdings?

Each time you send ALIEN, 1% of the amount is purchased on the open market and sent to a burn address. Over time this reduces total supply, which can increase the token’s scarcity and potentially its price.

Do I need the LIQUID, BURN, and 808 tokens to earn rewards?

Yes. The full reward stream-pTGC plus the three amplifiers-only triggers when you stake pTGC alongside all three amplifier tokens. Holding just ALIEN will still earn burn benefits but not the additional pTGC rewards.

Where can I see the latest ALIEN price?

The most reliable sources are DEX analytics like DEXTools or the pTGC dashboard, which pull on‑chain data directly. Third‑party aggregators may show outdated or conflicting numbers.

Is the airdrop still available?

The initial 1:1 airdrop was a one‑time event for early pTGC stakers. New participants can still receive ALIEN indirectly by staking pTGC with the amplifiers, which continually generates fresh ALIEN tokens through the protocol’s mint‑and‑burn cycle.

Bottom Line

Alien (ALIEN) is a highly specialized meme token that thrives on the health of the pTGC ecosystem. Its multi‑layered buy‑and‑burn system creates built‑in scarcity, but the same mechanism also ties the token’s upside to transaction volume. If you’re already involved in pTGC, grabbing ALIEN can add a modest yield on top of your staking rewards. For newcomers, the steep learning curve and limited liquidity warrant caution. As always, only invest what you can afford to lose and keep an eye on the broader pTGC developments.

Richard Herman

April 10, 2025 AT 18:47The 1% burn tax on every ALIEN transfer creates a modest deflationary pressure, which can help sustain value over time. Coupled with the additional 4% allocation toward pTGC, liquidity, and other tokens, the model tries to reward holders while funding ecosystem growth. It’s a fairly standard meme‑token design, but the explicit burn calculator is a nice transparency tool for users.

Parker Dixon

April 11, 2025 AT 10:04Exactly! 😊 The burn calculator lets you see the net tokens after each move, so you’re never surprised by hidden fees. Plus, the 4% split across pTGC, LIQUID, BURN, and 808 gives a diversified kick‑back, which is handy if you’re juggling different projects.

Stefano Benny

April 12, 2025 AT 01:21While the token claims a “deflationary” edge, a 1% burn is practically negligible against typical market volatility. The 4% tax essentially functions as a liquidity drain, redistributing value without genuine utility-just a classic pump‑and‑dump veneer masked in tokenomics jargon.

Bobby Ferew

April 12, 2025 AT 16:37Sure, the burn feels like a clever gimmick, but in reality it’s another layer of tax that leeches away potential gains. The jargon‑laden description does little to mask the fact that most holders end up paying fees each time they move a token.

celester Johnson

April 13, 2025 AT 07:54One might contemplate the existential irony of a token that burns itself to survive; it mirrors our own pursuits of relevance amidst entropy. Yet, the token’s architecture remains a shallow echo of deeper economic principles, offering more spectacle than substance.

Prince Chaudhary

April 13, 2025 AT 23:11Let’s keep perspective: the burn mechanism can be a useful tool for long‑term holders who are patient. By staying disciplined and understanding the fee structure, you can navigate the token’s twists and still benefit from potential upside.

John Kinh

April 14, 2025 AT 14:27Honestly, it sounds like hype to me… 🙄 A 1% burn won’t change anything if the market is already shaky.

Mark Camden

April 15, 2025 AT 05:44From a regulatory standpoint, the inclusion of explicit burn and redistribution percentages aligns with current best practices for transparency. However, investors should remain vigilant: the token’s utility remains limited, and market dynamics could render the burn moot.

Evie View

April 15, 2025 AT 21:01Stop pretending this is anything but a cash grab! The burn is just a marketing ploy to lure naive buyers while the developers scoop the rest.

Kate Roberge

April 16, 2025 AT 12:17Whoa, that’s a bit harsh, but you’ve got a point. The token does lean heavily on hype over real utility.

Oreoluwa Towoju

April 17, 2025 AT 03:34The burn tax is 1%; the allocation tax is 4% split among four tokens.

Jason Brittin

April 17, 2025 AT 18:51Wow, groundbreaking insight there! 🙃 Thanks for the TL;DR, now we can all pretend we understand the math.

Amie Wilensky

April 18, 2025 AT 10:07Indeed; the token’s mechanics are straightforward: a 1% burn, a 4% redistribution, and the remainder transferred to the recipient. One must, however, consider the cumulative effect of repeated transactions.

MD Razu

April 19, 2025 AT 01:24The notion of a “burn” within a digital currency evokes a paradoxical dance between creation and destruction, a theme that has resonated throughout economic thought since the earliest barter systems. In the case of ALIEN, the 1% token incineration per transaction serves as a symbolic relinquishment of value, intended to confer scarcity upon the remaining supply. Yet, scarcity alone does not guarantee intrinsic worth; it must be paired with utility, community trust, and sustainable demand. The additional 4% tax, subdivided among pTGC, LIQUID, BURN, and 808, attempts to weave a tapestry of inter‑token relationships, fostering a micro‑ecosystem where each component supports the other. This interdependence, while conceptually elegant, introduces layers of complexity that may obscure the token’s primary purpose for the casual investor. Moreover, the perpetual burning process mirrors natural entropy, reminding participants that value can erode as quickly as it is generated. From a behavioral economics perspective, the burn may trigger a loss‑aversion bias, prompting holders to cling tighter to their assets out of fear of diminution. Conversely, the redistribution component could incentivize frequent trading, as participants seek to capture the ancillary benefits embedded within the tax. The duality of these incentives creates a delicate equilibrium, one that can collapse under market pressure if sentiment shifts. Historical precedents in meme‑coin arenas reveal that such mechanisms often ride waves of hype, only to stall when speculative fervor wanes. Therefore, while the tokenomics present a theoretically sound framework, the real test lies in community adoption and sustained utility beyond mere speculative trading. In practice, the burn calculator provided offers transparency, granting users a clear view of net outcomes after each transaction, thereby mitigating hidden‑fee concerns. Nonetheless, transparency does not equate to legitimacy; the underpinning project must deliver tangible use‑cases to substantiate its value proposition. As with any emergent asset class, due diligence, patience, and a measured appetite for risk are paramount. Ultimately, the ALIEN token stands at the intersection of innovative token design and the age‑old cautionary tale of speculative excess, awaiting validation through community conviction and real‑world application.

Charles Banks Jr.

April 19, 2025 AT 16:41Great, another 16‑sentence sermon-thanks for the novella, I’ll be sure to read it between my coffee breaks.

Ben Dwyer

April 20, 2025 AT 07:57Keep in mind that understanding these mechanics takes time; don’t be discouraged if it feels overwhelming at first.

Lindsay Miller

April 20, 2025 AT 23:14The burn fee might seem small, but over many trades it can add up, so it’s good to plan your moves wisely.

Katrinka Scribner

April 21, 2025 AT 14:31Totally get it! 😅 Even a tiny burn can surprise you if you’re not watching, so stay sharp and happy hunting!

VICKIE MALBRUE

April 22, 2025 AT 05:47Every little burn nudges the token toward lasting value!

Waynne Kilian

April 22, 2025 AT 21:04I think the multi‑token split after the 4% tax could actually help build a stronger ecosystem if the community rallies around each piece.

Naomi Snelling

April 23, 2025 AT 12:21Sure, but you never know who's really pulling the strings behind those split allocations-keep your eyes peeled.

Michael Wilkinson

April 24, 2025 AT 03:37Listen up: the burn alone won’t save a token that lacks real purpose. If the project doesn’t deliver, the deflation is meaningless.

Billy Krzemien

April 24, 2025 AT 18:54Agreed, purpose drives sustainability; focusing on real‑world use cases will make any burn mechanism worthwhile.

april harper

April 25, 2025 AT 10:11Another day, another token promising miracles while delivering the same old empty hype.

Clint Barnett

April 26, 2025 AT 01:27Picture this: a galaxy of tokens swirling around a central star, each shedding a whisper of its essence in a cosmic dance of scarcity. ALIEN’s 1% burn is that starlight, a faint glimmer that, over time, can illuminate the darkness of oversupply. Meanwhile, the 4% tax disperses its energy across four neighboring constellations-pTGC, LIQUID, BURN, and 808-creating a constellation of interlinked value. This celestial choreography, when imagined beyond the bland spreadsheet, suggests a universe where every transaction nudges the balance toward equilibrium. Yet, the reality remains rooted in code and market sentiment; the brilliance of this vision hinges on whether participants truly buy into the spectacle. If the community embraces the narrative, the token could ascend like a comet, trailing interest and attention. If not, it may fizzle like a forgotten meteor, leaving only the burned remnants as a cautionary tale. Either way, the design invites us to contemplate the metaphysics of digital scarcity, reminding us that even bits and bytes can partake in a grand, interstellar story.