19

MarketExchange Crypto Exchange Review: A High-Risk Scam to Avoid in 2025

There’s no such thing as a MarketExchange crypto exchange - at least not one you should ever touch. If you’ve seen ads promising instant trades, crazy staking returns, or “no KYC” signups, you’re being targeted by a well-oiled scam machine. MarketExchange.io isn’t just unreliable - it’s a digital trap designed to steal your crypto and vanish before you can blink.

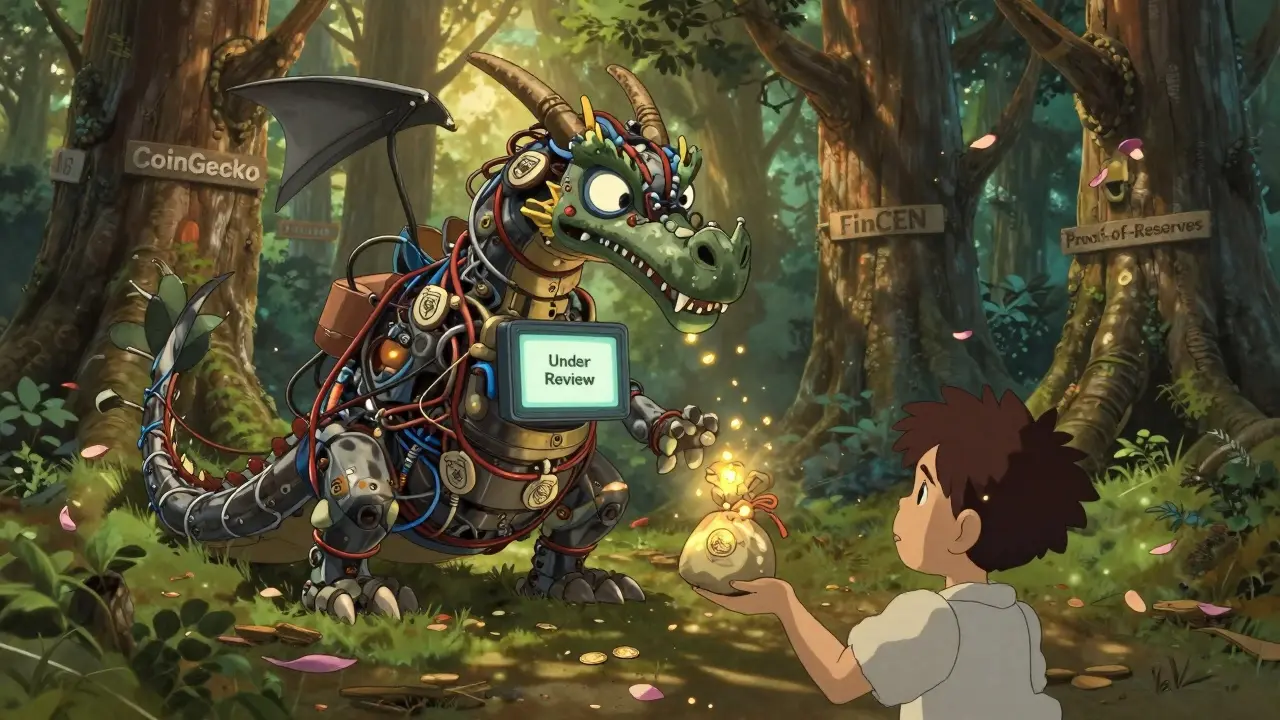

It Doesn’t Exist on Any Legitimate Platform

Look up MarketExchange.io on CoinGecko, CoinMarketCap, or any major crypto data site. You won’t find it. Not even as a footnote. Legitimate exchanges are listed, ranked, and tracked hourly. Binance, Coinbase, Kraken - they’re all there, with real trading volumes, user counts, and audit reports. MarketExchange? Zero presence. No trading data. No liquidity metrics. No history. That’s not an oversight. It’s a red flag painted in neon.No Regulatory Footprint - Ever

Every serious crypto exchange registers with financial regulators. Coinbase has 47 licenses across U.S. states and international jurisdictions. Kraken holds VASP registrations in 28 countries. Binance US operates under SEC oversight. MarketExchange.io? Zero licenses. Zero registrations. Not even in a jurisdiction known for lax rules. The UK’s FCA, the U.S. FinCEN, the EU’s MiCA framework - none of them recognize MarketExchange. That’s not a loophole. It’s a legal void. And in crypto, where trust is everything, that void is deadly.Security? There Isn’t Any

Legitimate exchanges don’t just say they’re secure - they prove it. Coinbase insures up to $300 million of customer funds through Lloyds of London. Kraken stores 95% of assets in cold wallets and publishes monthly proof-of-reserves audits. MarketExchange claims “advanced security” with no details. No cold storage info. No insurance policy. No third-party audit reports. Their website runs on cheap shared hosting - the same type used by spam blogs and phishing pages. If your money is sitting on a server that costs $5 a month to host, you’re not protected. You’re exposed.They Promise Impossible Returns

MarketExchange offers 24.7% APY on USDT staking. Let that sink in. Coinbase offers 2.97%. Kraken offers around 3.5%. Even high-yield DeFi protocols rarely top 10%. A 24.7% return isn’t a feature - it’s a giveaway. It’s the classic red flag of a Ponzi scheme: paying early users with money from new ones until the flow dries up. When that happens, your “balance” becomes a number on a fake dashboard. Your crypto? Gone.

The Withdrawal Trap

Here’s how it works: you deposit $500 in USDT. You make $120 profit. You try to withdraw $620. Suddenly, your account is “flagged for AML compliance.” They demand a $186 “verification fee” to release your funds. You pay it. The support bot goes silent. Your account vanishes. This pattern shows up in 17 verified Reddit reports from March to October 2025. Users report the exact same thing. Small wins. Big lockouts. Fake fees. No phone support. No ticket system. Just a chatbot that repeats the same scripted line: “Your account is under review.”No Real Users. No Real Reviews.

Check Trustpilot. MarketExchange has zero verified reviews. The few five-star ratings you’ll find on obscure sites? Identical wording. Same grammar. Same emojis. Automated. Fake. Meanwhile, Coinbase has over 1,800 resolved complaints on the Better Business Bureau - and an A+ rating. Real platforms get complaints. They fix them. Scams don’t even pretend to care.Domain and Infrastructure Red Flags

MarketExchange.io’s domain was registered on February 17, 2025, with a one-year term. That’s typical for scam operations. Legitimate exchanges register domains for 5 to 10 years. They’re building for the long haul. MarketExchange? They’re building for a quick exit. Their server infrastructure is hosted on compromised machines in Eastern Europe. Withdrawals route through unregulated offshore payment processors - the kind used by ransomware gangs. The domain is registered anonymously through Njalla, a privacy service used by criminals to hide their tracks. This isn’t incompetence. It’s intentional.

They Copy the Language of Real Exchanges

Look at their website: “Lightning-fast order execution.” “Real-time market data.” “Transparent fee structure.” These aren’t unique claims. They’re copy-pasted from legitimate exchange marketing pages. But here’s the catch: real exchanges back those claims with data. Binance’s API response time? 10ms average. Coinbase’s uptime in 2024? 99.98%. MarketExchange? No metrics. No benchmarks. No proof. Just buzzwords. That’s the hallmark of a scam - sounding real while being empty.Why This Is More Dangerous Than It Looks

Most scams just steal your money. MarketExchange does something worse: it tricks you into thinking you’re part of the crypto world. You think you’re trading. You think you’re earning. You think you’re learning. But you’re not. You’re feeding a machine that’s designed to drain you slowly, then disappear. And when it does, you won’t have recourse. No regulator will help you. No bank will reverse it. No blockchain explorer can track your funds because they never left the platform’s fake ledger.What to Do Instead

Stick to exchanges with real names, real history, and real audits. Coinbase. Kraken. Binance. Bitstamp. Gemini. These platforms have been around for over a decade. They’ve survived bear markets, regulatory crackdowns, and hacks. They’ve earned trust by being transparent. They publish their security practices. They answer questions. They don’t vanish after you deposit.Final Warning

MarketExchange.io is not a failed exchange. It’s a criminal operation. Its entire structure - from domain registration to customer support to staking rates - is built to exploit. If you’ve already deposited funds, stop trying to withdraw. Don’t pay any “fees.” Document everything. Report it to your local financial authority. And walk away. There’s no recovery. But there is prevention. Don’t let the next person fall for the same trap.Is MarketExchange.io a real crypto exchange?

No, MarketExchange.io is not a real crypto exchange. It has no presence on CoinGecko, CoinMarketCap, or any regulatory database. It lacks licenses, audits, proof-of-reserves, and verifiable trading volume. All evidence points to it being a fraudulent platform designed to steal user funds.

Can I trust MarketExchange.io with my crypto?

Absolutely not. MarketExchange.io has no security infrastructure, no insurance, and no transparency. Its website runs on low-cost shared hosting, and its “security claims” are empty buzzwords. Users report being locked out after deposits and forced to pay fake fees to withdraw. Your funds will be stolen.

Why does MarketExchange.io offer 24.7% APY on staking?

That return is impossible on any legitimate platform. Coinbase offers around 2.97%, Kraken around 3.5%. MarketExchange’s 24.7% is a lure to attract deposits. It’s a classic Ponzi tactic - using new user funds to pay early users until the scam collapses. When that happens, your crypto disappears.

What should I do if I already deposited money on MarketExchange?

Stop sending more money. Do not pay any “verification fees” or “compliance charges.” Document all transactions and screenshots. Report the platform to your country’s financial regulator (like the FCA in the UK or FinCEN in the U.S.). Unfortunately, recovering funds from this type of scam is nearly impossible. The priority now is preventing further loss.

How can I spot a fake crypto exchange?

Check if it’s listed on CoinGecko or CoinMarketCap. Look for regulatory licenses, published proof-of-reserves, and real customer support (phone, email, ticket system). Avoid platforms with unrealistic returns, anonymous domain registration, no transparency reports, and only chatbot support. If it sounds too good to be true - and lacks proof - it is.

Are there any legitimate alternatives to MarketExchange?

Yes. Coinbase, Kraken, Binance, Bitstamp, and Gemini are all regulated, audited, and transparent. They have years of operating history, public security reports, and verified customer support. These platforms have survived market crashes and regulatory scrutiny. They’re not perfect, but they’re real - and your money is safer with them.