16

SIL Finance (SIL) Airdrop: Eligibility, Claim Steps & Token Details

SIL Airdrop Eligibility Checker

Airdrop Eligibility Assessment

Enter your Bitget and wallet details to check if you qualify for the SIL Finance airdrop

Your Eligibility Status

Anyone hunting for a free crypto windfall has probably seen the name SIL Finance airdrop pop up on forums and social feeds. But the hype masks a confusing reality: the token’s price flips between zero and $21 depending on which site you glance at, and the official airdrop program is barely documented. This guide pulls together everything you can verify as of October 2025 - from the project’s core idea and token specs to the exact steps you need to take if you want a shot at the next SIL distribution.

What is SIL Finance?

SIL Finance is a decentralized finance (DeFi) platform that automates yield‑farming decisions for users. The project brands itself as “Sister In Law,” a tongue‑in‑cheek nod to its goal of acting as a financial intermediary between established yield‑farming protocols such as YFI (Yearn.Finance) and YFII (Yearn.Finance II). By scanning metrics like annualized return, safety factor, and management cycle, SIL Finance attempts to assign each user the most profitable liquidity‑mining product without manual research.

Token basics - SIL

The native token carries the ticker SIL. According to the project’s white‑paper, the maximum supply is capped at 30,000 SIL. The token lives on the Ethereum blockchain, with the smart‑contract address 0x133B…FF3a13C. Unfortunately, most market aggregators list the token’s circulating supply as zero, and price data is wildly inconsistent.

Current market picture - why the price is muddled

Three major trackers paint a contradictory picture as of September2025:

- CoinMarketCap shows a price of $0.00, market cap $0, total supply 0, and circulating supply 0.

- Bitget mirrors the same $0.00 reading, with no 24‑hour volume reported.

- In stark contrast, Crypto.com lists SIL.FINANCE at $21.01, albeit without any trade‑volume data.

These gaps hint at either a data‑feed error, a token that is not listed on major exchanges, or a project that is effectively dormant. Until a reliable exchange lists SIL with transparent order books, the price will remain speculative.

How the airdrop works - what we know

Bitget’s September2025 update mentions that users can “receive free SIL Finance airdrops by joining ongoing challenges and promotions.” No official blog post or detailed token‑distribution schedule is publicly available, which means the airdrop is likely community‑driven - i.e., you must complete specific tasks on partner platforms to become eligible.

Based on comparable DeFi airdrop structures, the typical eligibility chain includes:

- Holding a baseline amount of a partner token (often BNB, USDT, or ETH) on a supported exchange.

- Linking a Web3 wallet (e.g., MetaMask) to the promotional platform.

- Participating in a yield‑farming demo or test run on SIL Finance’s UI.

- Completing KYC (if the platform mandates it) to prevent bot abuse.

Because the exact task list is not published, the safest bet is to monitor Bitget’s “Airdrop” or “Promotions” page daily, join their Telegram and Discord channels, and be ready to act when a new challenge appears.

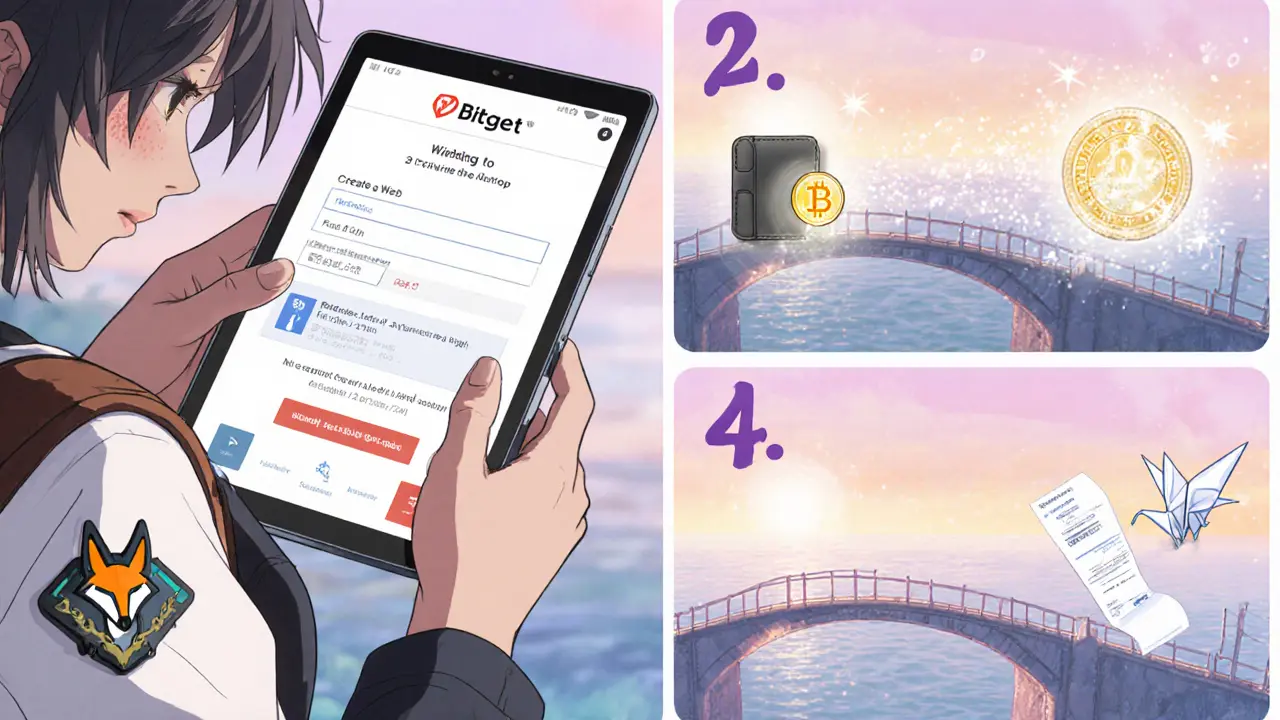

Step‑by‑step guide to claim a potential SIL airdrop

- Create a Web3 wallet. MetaMask, Trust Wallet, or Coinbase Wallet work fine. Write down the seed phrase in a secure place.

- Fund the wallet. Acquire a modest amount of ETH (≈0.05ETH) to cover gas fees when you interact with SIL contracts.

- Register on Bitget. Sign up using a verified email, enable two‑factor authentication, and complete any required KYC steps.

- Link your wallet. In Bitget’s “Airdrop” section, click “Connect Wallet” and approve the connection in MetaMask.

- Watch for official prompts. When Bitget announces a SIL challenge (e.g., “Stake 100USDT for 7days”), follow the instructions exactly. Usually you’ll need to deposit the specified token into a smart contract via the Bitget interface.

- Submit proof. Some promotions require a screenshot of the transaction hash or a link to a blockchain explorer showing your deposit.

- Wait for distribution. Airdrops typically arrive within 1‑2 weeks after the challenge ends. Check your wallet for a new SIL balance and confirm the token appears in your wallet’s token list (add the contract address if needed).

Checklist before you jump in

| Item | Why it matters | Do it? |

|---|---|---|

| Secure wallet seed phrase | Prevents loss if you need to restore access | Yes |

| Enough ETH for gas | Transactions on Ethereum cost gas; without ETH you can’t claim | Yes |

| Completed KYC on Bitget | Many airdrops ban anonymous accounts | Yes (if required) |

| Follow official Bitget channels | Ensures you hear about new challenges first | Yes |

| Double‑check contract address | Avoids phishing tokens that mimic SIL | Yes |

Red flags and risk mitigation

The SIL ecosystem shows several warning signs:

- Zero trading volume. If no exchange lists the token, liquidity is virtually nonexistent.

- Conflicting price data. A $0 versus $21 discrepancy suggests data‑feed errors or outright scams.

- Lack of official documentation. The project’s website barely mentions the airdrop, and social media activity is minimal.

To protect yourself:

- Never send more than you can afford to lose. A small upfront ETH amount for gas is enough.

- Verify the contract address on Etherscan before adding the token to your wallet.

- Cross‑check announcements on multiple sources - official Bitget posts, the SIL Finance GitHub, and reputable crypto news sites.

Alternative ways to earn SIL - if airdrop isn’t enough

Should the free drop fall short, you can still acquire SIL (if it ever gets listed) by:

- Participating in SIL Finance’s yield‑optimization service once it launches on a live testnet.

- Swapping on decentralized exchanges (DEXes) that list SIL - you’ll need the exact contract address.

- Joining community bounty programs that reward code contributions or marketing help.

Future outlook - what to watch in 2025‑2026

Key signals that could move SIL from “dormant” to “active” include:

- A partnership announcement with a major DeFi protocol (e.g., integration with Curve or Aave).

- Listing on a reputable centralized exchange (Binance, KuCoin, or Kraken).

- Release of a detailed tokenomics paper that outlines staking rewards, governance rights, and supply lock‑ups.

Until one of those milestones hits, the airdrop remains the only low‑cost entry point for curious users.

Frequently Asked Questions

What is the official source for SIL Finance airdrop announcements?

Bitget’s “Airdrop” or “Promotions” page is currently the only platform that publishes SIL‑related challenges. Follow Bitget’s official Telegram, Discord, and Twitter for real‑time updates.

Do I need to hold any other token to qualify?

Most SIL challenges require a small deposit of a major stablecoin (USDT, USDC) or ETH. The exact amount varies per promotion and is outlined in the Bitget challenge description.

Is SIL listed on any major exchange?

As of October2025, no major exchange shows a live order book for SIL. The token appears on a few DEX aggregators with negligible volume, and price data is inconsistent across sites.

Can I add SIL to MetaMask manually?

Yes. In MetaMask, click “Add Token,” choose “Custom Token,” and paste the contract address 0x133B...FF3a13C. After confirming, the token will appear in your wallet.

What are the biggest risks of participating?

The main risks are: (1) the token may never gain liquidity, making any earned SIL effectively unusable; (2) phishing scams that mimic the airdrop; and (3) gas fees that outweigh the value of the received tokens.

Kyla MacLaren

October 16, 2025 AT 08:13Make sure you double‑check the contract address 0x133B…FF3a13C on Etherscan before adding SIL to youre wallet.

Linda Campbell

October 22, 2025 AT 08:13It is imperative for American investors to verify that any airdrop claim originates from an officially sanctioned platform, lest they fall prey to foreign entities seeking to exploit domestic capital.

John Beaver

October 28, 2025 AT 07:13When you connect your MetaMask, ensure the gas limit is set a bit higher than the defualt; otherwise the transaction may revert and you’ll lose the ETH you spent on gas.

EDMOND FAILL

November 3, 2025 AT 07:13Notice how the price data swings wildly between $0 and $21 – that’s a classic sign the token isn’t actively traded on any major exchange.

Jennifer Bursey

November 9, 2025 AT 07:13First, the token’s ambiguous pricing signals a liquidity vacuum that any serious yield‑farmer should avoid; second, the absence of a transparent tokenomics whitepaper makes risk modeling virtually impossible.

Third, community‑driven airdrops often serve as a marketing funnel, funneling users toward future protocol upgrades that may never materialize.

Moreover, the reliance on Bitget’s promotional engine introduces an extra layer of custodial exposure, which contradicts the core DeFi principle of non‑custodial ownership.

Another point: the contract address, while publicly available, lacks verification badges on major block explorers, raising questions about provenance.

From a technical standpoint, the gas‑cost estimates for claim transactions appear inflated, hinting at potential inefficiencies in the smart contract code.

In addition, the token supply cap of 30,000 SIL is minuscule compared to typical DeFi projects, suggesting a scarcity model that could be easily manipulated.

Strategically, the platform’s naming-Sister In Law-may be a tongue‑in‑cheek branding effort, but it also obscures the seriousness of its financial aspirations.

Investors should also be aware that no major exchange lists SIL, meaning secondary market depth is effectively zero.

Consequently, any SIL acquired through the airdrop will likely sit idle unless a liquidity bootstrapping event occurs.

Pragmatically, one should allocate only a negligible portion of their portfolio to such speculative assets, treating any potential reward as a bonus rather than a core holding.

Finally, continuous monitoring of Bitget’s official channels is essential, as challenge parameters can change with little notice, and missing a deadline could forfeit the entire airdrop opportunity.

Overall, while the prospect of free tokens is alluring, the underlying fundamentals warrant a cautious, data‑driven approach before committing any resources.

Maureen Ruiz-Sundstrom

November 15, 2025 AT 07:13The entire SIL initiative reeks of hype masquerading as innovation, and without transparent tokenomics it remains a speculative mirage for the unwary.

Kevin Duffy

November 21, 2025 AT 07:13👍 Keep an eye on Bitget’s promo channel – they often drop quick challenges that can net you a handful of SIL for virtually free gas.

Kim Evans

November 27, 2025 AT 07:13Sounds legit, but always verify the source first. :)

Steve Cabe

December 3, 2025 AT 07:13American crypto participants should demand that exchanges list SIL only after rigorous compliance checks, ensuring our market integrity remains untainted.

shirley morales

December 9, 2025 AT 07:13In reality the airdrop is a fleeting curiosity without substance

Millsaps Crista

December 15, 2025 AT 07:13Good point, keep your eyes peeled and set up price alerts so you don’t miss the narrow windows when the challenge opens.

Matthew Homewood

December 21, 2025 AT 07:13The transient nature of such airdrops mirrors the impermanence of value itself, prompting us to reflect on what we truly seek in decentralized finance.

Jeff Moric

December 27, 2025 AT 07:13Absolutely, verification is key; a quick look at the Bitget announcement page can clarify whether the airdrop is officially sanctioned or a community‑run stunt.

Bruce Safford

January 2, 2026 AT 07:13But consider that many “official” pages are themselves fronts for coordinated pump‑and‑dump schemes orchestrated by shadow groups operating beyond any single jurisdiction’s reach.

Blue Delight Consultant

January 8, 2026 AT 07:13While the hypothesis of covert manipulation is intriguing, without concrete evidence it remains speculative and should not deter diligent investors from conducting standard due diligence.

Wayne Sternberger

January 14, 2026 AT 07:13Indeed, adhering to best practices-such as confirming the contract address, limiting exposure to gas fees, and maintaining a secure seed phrase-provides a solid defense against both overt scams and subtle market manipulation.

Gautam Negi

January 20, 2026 AT 07:13Even if you think the challenges are harmless, the broader ecosystem may be using these micro‑airdrops to funnel users into larger, less transparent DeFi protocols.

Shauna Maher

January 26, 2026 AT 07:13That’s exactly why many seasoned traders avoid these gimmicks altogether; the risk‑reward ratio seldom justifies the time spent tracking fickle promotions.

Tayla Williams

February 1, 2026 AT 07:13From an ethical standpoint, promoting a token with unclear utility raises concerns about the responsible stewardship of community capital.

Brian Elliot

February 7, 2026 AT 07:13To add, if SIL ever lands on a DEX, you’ll need to import the token manually using the same contract address, then monitor liquidity pools for any meaningful price discovery.

Marques Validus

February 13, 2026 AT 07:13Yo the whole SIL saga is just another hype cycle-new token, flashy promos, and then poof the community’s attention evaporates into thin air; stay vigilant and don’t let the hype train run you over