Cryptocurrency Sanctions: What They Are, Who Enforces Them, and How They Impact You

When governments impose cryptocurrency sanctions, restrictions placed on crypto transactions, wallets, or exchanges to block illicit finance or enforce foreign policy. Also known as crypto compliance crackdowns, these measures are no longer theoretical—they’re active, enforced, and growing more precise every year. This isn’t about banning Bitcoin. It’s about cutting off specific actors, platforms, or jurisdictions that use crypto to evade traditional financial controls.

Take the EU sanctions, a coordinated set of financial restrictions under the European Union’s legal framework targeting entities linked to terrorism, war crimes, or money laundering. They don’t just freeze bank accounts—they now freeze crypto wallets tied to sanctioned individuals. The MiCA, the Markets in Crypto-Assets Regulation, the EU’s first unified crypto rulebook, forces exchanges to verify users, report suspicious activity, and block transactions linked to blacklisted addresses. It’s not optional. If you’re trading on a platform that doesn’t comply, you’re at risk—even if you didn’t know the rules.

It’s not just Europe. The U.S. Treasury’s OFAC list includes crypto addresses. Iran’s traders use VPNs to bypass restrictions, but detection tools are catching up. India banned unregistered exchanges. Even small nations like Singapore and Switzerland now require crypto firms to prove they’re not helping sanctioned entities. These aren’t isolated actions—they’re part of a global shift. The Crypto-Asset Reporting Framework, a new international standard that forces financial institutions to share crypto transaction data with tax and law enforcement agencies means your trading history could end up in a government database without your consent.

So what does this mean for you? If you’re holding tokens tied to a project that got flagged, you might find your wallet frozen. If you’re using an exchange that doesn’t screen users, you could be fined—even if you didn’t break any laws yourself. Compliance isn’t about being suspicious. It’s about being aware. The posts below break down real cases: how the EU is enforcing MiCA, why certain exchanges vanished overnight, how airdrops get blocked, and what happens when a crypto project gets caught in a sanctions net. You’ll see how PureVidz, BB EXCHANGE, and even meme coins like VoldemortTrumpRobotnik-10Neko fit into this bigger picture—not because they’re illegal, but because they’re invisible to regulators. And you’ll learn how to spot the red flags before they become your problem.

9

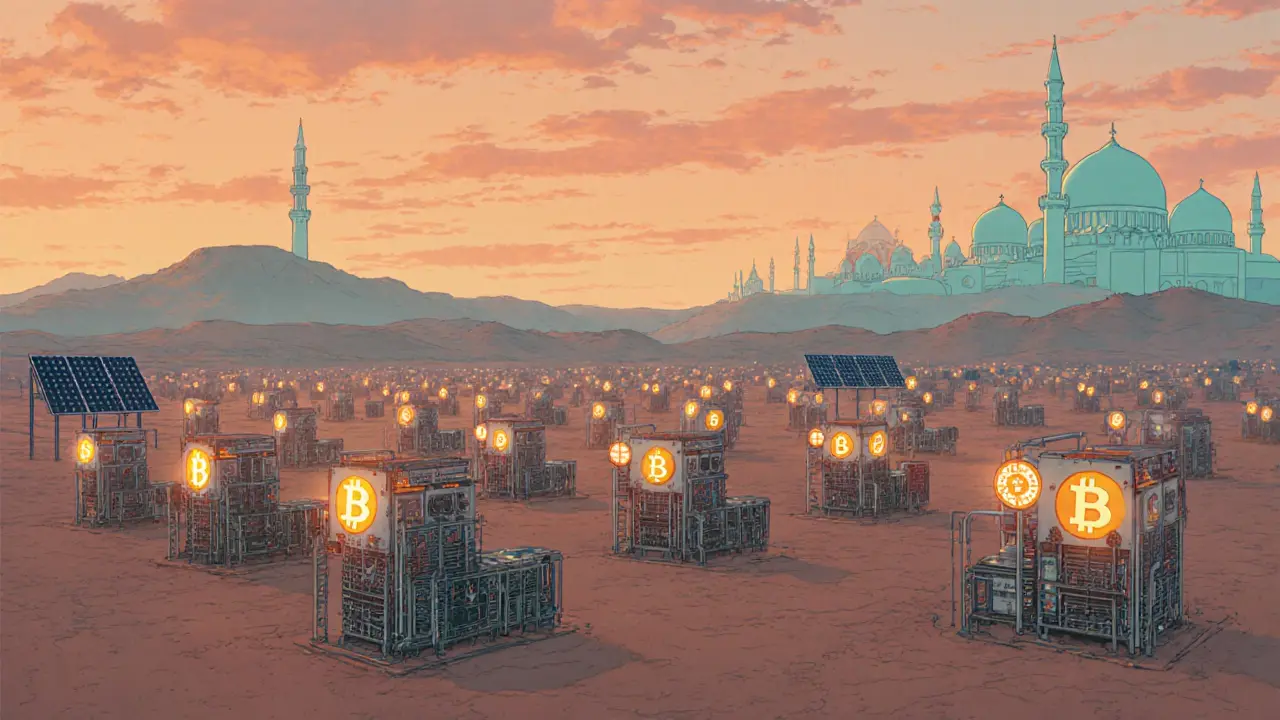

How Iran Uses Bitcoin Mining to Bypass International Sanctions

Iran uses its cheap energy and state-backed infrastructure to mine Bitcoin at scale, bypassing international sanctions by converting electricity into hard currency without relying on Western banks or payment systems.

Latest Posts

Popular Posts

Tags

- decentralized exchange

- crypto exchange

- crypto exchange review

- cryptocurrency

- crypto airdrop 2025

- CoinMarketCap airdrop

- blockchain

- meme cryptocurrency

- GENIUS Act

- cryptocurrency compliance

- crypto airdrop

- meme coin

- crypto trading

- fake crypto exchange

- Solana meme coin

- cryptocurrency valuation

- Binance Smart Chain

- underground crypto Nepal

- crypto airdrop guide

- crypto staking